There are so many benefits to using a cryptocurrency, that it would seem foolish to neglect such an invention. For example, it allows you to send money anywhere in the world in an instant, with basically no fees involved. Everyone can be included in the financial system, it will change the way we interact with money, it can prevent fraud, and much more.

Saturday, December 31, 2022

Central Bank of Turkey Reports First Payment Transactions on Digital Lira Network

The Central Bank of the Republic of Turkey (CBRT) has conducted the first payment transactions on the test network of the digital lira. The monetary authority intends to proceed with more testing in 2023 and plans to invite banks and fintech companies to join the trials.

Turkey to Widen Participation in Digital Lira Project, Focus on Studying Economic and Legal Aspects

Turkey’s monetary authority has successfully carried out the first payment transactions on the Digital Turkish Lira Network, according to an announcement on Thursday. The operations were executed as part of studies during the first phase of the central bank digital currency (CBDC) project.

The CBRT also said it will continue to perform pilot tests with technology stakeholders in the first quarter of next year, on a limited scale and in a closed-circuit environment. The findings from these tests will be revealed to the public in a comprehensive evaluation report, it promised.

Also in 2023, the Turkish central bank intends to expand the collaboration platform for the digital lira. Selected banks and financial technology companies will be involved and advanced phases of the pilot study unveiled to further widen participation, the regulator detailed, elaborating:

Against this backdrop, the CBRT will continue to run tests for authentic architectural setups designed in areas such as the use of distributed ledger technologies in payment systems and the integration of these technologies with instant payment systems.

The bank also emphasized that examination of the legal aspects of the CBDC has shown that “digital identification is of critical importance for the project.” For this reason, the CBRT intends to prioritize studies on the legal and economic framework of the digital lira as well as its technological requirements.

The potential issuing of a “blockchain-based” version of the Turkish lira was first mentioned in President Recep Erdogan’s Annual Program in November, 2019. Two years later, the CBRT deepened research into the matter by establishing the Digital Turkish Lira Collaboration Platform to facilitate the development and testing of the CBDC with technology stakeholders.

Do you think the Central Bank of Turkey will step up efforts to introduce a digital Turkish lira? Share your expectations in the comments section below.

from Bitcoin News https://ift.tt/R6s7myW

via IFTTT

Musk is not and never should have been a symbol of crypto.

Crypto, true crypto, is an anarchist vision. No gods, no masters. No banks, no top-down authority. Cooperation through voluntary association based on an agreed code of conduct.

Musk, on the other hand, is a fascist. He treats his employees like well-compensated slaves. He takes control of information networks in order to "save" them. He is closely associated with and supportive of the Xi regime, which does reality control and social monitoring sht straight out of 1984 (and before you say that China is communist, please look up the actual definitions of communism and fascism and then think about what China actually looks like rather than what it calls itself). For fcks sake, Musk even plans to mass implant chips in people's brains. You can't make this sht up.

There is a thin line between genius and insanity and intellectual ability does not translate into a strong sense of morality. Musk is not on the side of those who value human dignity and liberty, and he is not what crypto stands for.

Submitted December 30, 2022 at 11:11PM by DoItYrselfLiberation https://ift.tt/aV4PDcp https://ift.tt/fJwDUEF

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/bvZtF6w

via IFTTT

MicroStrategy Hit Lowest Since 2020 After Bitcoin Sale - Yahoo Finance

from Google Alert - Bitcoin https://ift.tt/evNAGDg

Bitcoin: Probably Lost Supply - Glassnode Studio

from Google Alert - Bitcoin https://ift.tt/KpO9JfP

Musk is not and never should have been a symbol of crypto.

Crypto, true crypto, is an anarchist vision. No gods, no masters. No banks, no top-down authority. Cooperation through voluntary association based on an agreed code of conduct.

Musk, on the other hand, is a fascist. He treats his employees like well-compensated slaves. He takes control of information networks in order to "save" them. He is closely associated with and supportive of the Xi regime, which does reality control and social monitoring sht straight out of 1984 (and before you say that China is communist, please look up the actual definitions of communism and fascism and then think about what China actually looks like rather than what it calls itself). For fcks sake, Musk even plans to mass implant chips in people's brains. You can't make this sht up.

There is a thin line between genius and insanity and intellectual ability does not translate into a strong sense of morality. Musk is not on the side of those who value human dignity and liberty, and he is not what crypto stands for.

Submitted December 30, 2022 at 11:11PM by DoItYrselfLiberation https://ift.tt/aV4PDcp https://ift.tt/fJwDUEF

Friday, December 30, 2022

Dollar Loses to Digital Currencies in 2023, Former Russian President Medvedev Says

Digital fiat currencies will spread next year while the U.S. dollar will be losing its status of global reserve currency, according to Russia’s former head of state. In a string of tweets, Dmitry Medvedev gave his two cents on what the future holds for the world, a “humble contribution,” as he put it, to the “wildest predictions” ahead of New Year’s Eve.

Medvedev Sees World Bank Crashing, Musk in the White House and Expensive Oil

The Bretton Woods monetary system will collapse next year causing the International Monetary Fund and the World Bank to crash, according to the man who was at the helm of Russia for four years between two of Vladimir Putin’s presidential terms.

“Euro and dollar will stop circulating as the global reserve currencies. Digital fiat currencies will be actively used instead” while “all the largest stock markets and financial activity will leave the U.S. and Europe and move to Asia,” Dmitry Medvedev stated on social media.

Through a series of posts in a humorous tone this week, he gave his thoughts on what could happen in 2023. “On the New Year’s Eve, everybody’s into making predictions. Many come up with futuristic hypotheses, as if competing to single out the wildest, and even the most absurd ones. Here’s our humble contribution,” the leader of the ruling United Russia party tweeted on Monday.

Medvedev went on to forecast that oil prices will reach $150 a barrel and natural gas will top $5,000. He also expects the EU to collapse after the United Kingdom rejoins the bloc, and the euro to fall out of use. In a divided Europe, France and Germany will clash while Hungary and Poland will occupy parts of Western Ukraine, he added.

The Russian government official, now serving as Deputy Chairman of the country’s Security Council, sees California as an independent state and Texas leaving the U.S. to form an alliance with Mexico. “Elon Musk’ll win the presidential election in a number of states which, after the new Civil War’s end, will have been given to the GOP,” he wrote.

Dmitry Medvedev, who was also Russia’s prime minister between 2012 and 2020, and is regarded as a more liberal politician than Putin, has been quite active on social media since Moscow attacked Ukraine in late February. The military invasion was met with waves of Western sanctions. Days after the war started, he posted that Russia may “nationalize” foreign assets in response to the penalties.

Throughout the outgoing year, Russian authorities have been working to expand the legal framework for digital assets and regulate cryptocurrencies, in particular their use for cross-border settlements amid financial restrictions. While the Bank of Russia, which is developing its own digital ruble, proposed a blanket ban on crypto transactions in the country, Medvedev told Russian media in January that a prohibition could have the opposite effect.

Do you think any of Dmitry Medvedev’s predictions for 2023 could come true? Tell us in the comments section below.

from Bitcoin News https://ift.tt/KIxUH7m

via IFTTT

Sam Bankman just cashed out $600k, in violation of his bail release terms and conditions. A wallet directly linked to him has been using shady no-KYC exchanges to swap out

It seems that Sam Bankman is already violating his bail release terms and conditions.

As per his bail release, he may not transact over $1000 without approval. If he violates the terms, his bond may be forfeited - which means his parents home could be forfeited.

Lets look at what the scammer has been upto:

In 2020, he tweeted his wallet addresses in an effort to seek ownership control over SushiSwap.

Sam casually tweets his address out. ok uh

And just to confirm he completely controlled this address, the then head of SushiSwap - Nomichef tweets that he has transferred control of Sushi to Sam.

Nomi: I'm transferring control to SBFAlameda now.

And what do you know... this wallet was just emptied out, right after Sam got released on bail.

Here is the wallet: https://etherscan.io/address/0xd57581d9e42e9032e6f60422fa619b4a4574ba79 (lets label this as "0xd575")

Around 0.66eth was sent out from here to another wallet, thus emptying this wallet.

And if you follow the trail from here, the funds finally end up on a no-KYC exchange: https://etherscan.io/address/0xa8f296def58797cc48c5e6bdc047535b2eecaeab

Over $50k were swapped in this manner.

This is just in one wallet. One of the other intermediary wallet which received funds from "0xd575" is "0x7386". This wallet has recieved hundreds of thousand in the last couple of days, all of them eventually cashing out to no-KYC exchange.

Here is that intermediary wallet: https://etherscan.io/address/0x7386df2cf7e9776bce0708072c27d6a7135d51cb

The pattern is similar - the wallet receives funds, and swaps them via no-KYC exchange to launder the funds.

This shows that the wallet that is directly linked to Sam has been cashing out.

These are not transactions made by the Bankruptcy trustee, since any transaction they make has to be signed off by the bankruptcy court first and furthermore, they wouldnt use a no-kyc exchange to hide their trail.

Submitted December 29, 2022 at 11:15PM by Set1Less https://ift.tt/EJdnTxf https://ift.tt/Z2mV0eF

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/UmpH2fS

via IFTTT

free online casino baccarat. Betkings66.com . bitcoin ... - How You Brewin® Coffee Company

from Google Alert - Bitcoin https://ift.tt/xXnslkS

Bahamas regulator temporarily seizes FTX unit's assets worth over $3.5 bln

Submitted December 29, 2022 at 07:28PM by Feeling-Inside5147 https://ift.tt/6VtNYKQ https://ift.tt/Z2mV0eF

Markets: Bitcoin, Ether inch up; XRP biggest loser among top 10 - Forkast News

from Google Alert - Bitcoin https://ift.tt/jfDXWr5

Sam Bankman just cashed out $600k, in violation of his bail release terms and conditions. A wallet directly linked to him has been using shady no-KYC exchanges to swap out

It seems that Sam Bankman is already violating his bail release terms and conditions.

As per his bail release, he may not transact over $1000 without approval. If he violates the terms, his bond may be forfeited - which means his parents home could be forfeited.

Lets look at what the scammer has been upto:

In 2020, he tweeted his wallet addresses in an effort to seek ownership control over SushiSwap.

Sam casually tweets his address out. ok uh

And just to confirm he completely controlled this address, the then head of SushiSwap - Nomichef tweets that he has transferred control of Sushi to Sam.

Nomi: I'm transferring control to SBFAlameda now.

And what do you know... this wallet was just emptied out, right after Sam got released on bail.

Here is the wallet: https://etherscan.io/address/0xd57581d9e42e9032e6f60422fa619b4a4574ba79 (lets label this as "0xd575")

Around 0.66eth was sent out from here to another wallet, thus emptying this wallet.

And if you follow the trail from here, the funds finally end up on a no-KYC exchange: https://etherscan.io/address/0xa8f296def58797cc48c5e6bdc047535b2eecaeab

Over $50k were swapped in this manner.

This is just in one wallet. One of the other intermediary wallet which received funds from "0xd575" is "0x7386". This wallet has recieved hundreds of thousand in the last couple of days, all of them eventually cashing out to no-KYC exchange.

Here is that intermediary wallet: https://etherscan.io/address/0x7386df2cf7e9776bce0708072c27d6a7135d51cb

The pattern is similar - the wallet receives funds, and swaps them via no-KYC exchange to launder the funds.

This shows that the wallet that is directly linked to Sam has been cashing out.

These are not transactions made by the Bankruptcy trustee, since any transaction they make has to be signed off by the bankruptcy court first and furthermore, they wouldnt use a no-kyc exchange to hide their trail.

Submitted December 29, 2022 at 11:15PM by Set1Less https://ift.tt/EJdnTxf https://ift.tt/Z2mV0eF

Thursday, December 29, 2022

Gold-Based Digital Assets Issued in Russia

A blockchain platform built by Russia’s largest banking institution, Sber, has been used to issue digital assets based on gold. The value of the tokenized precious metal will depend on the prices of physical gold, the bank said, emphasizing that the operation is a first.

Russia’s Sber Bank Mints Gold-Backed Coins

Sber, Russia’s largest bank, has reported issuing gold-based digital financial assets (DFAs) on its proprietary blockchain. The coins were minted for Solfer, a holding specialized in the processing and trading of metals and making products from precious metals.

The Russian law “On Digital Financial Assets,” which entered into force in January, 2021, allows companies to tokenize various assets. Sber Bank is one of three “information system operators” authorized by the Bank of Russia to issue DFAs, alongside Atomyze and Lighthouse. The latter conducted Russia’s first DFA issue in June of this year.

The DFA issued for gold represents a monetary claim on the asset, Sber explained. Its price and the obligations associated with it will depend on the dynamics of gold prices, the bank elaborated in an announcement, noting this is the first transaction of this kind on its blockchain.

“We were attracted by the new digital format for gold, and we decided to try a new way to diversify the company’s balance sheet … We think that a new format of investment in precious metals can find its niche in the market,” commented Maxim Nazhmetdinov, the chief executive of Solfer.

“The deal demonstrates interest from the market and the real sector in a new instrument that can become a good alternative to investments within the de-dollarization of the economy,” First Deputy Chairman of Sber’s Board Alexander Vedyakhin stressed.

Pressed by sanctions over the war in Ukraine, Russia has been preparing to broaden its legal framework for DFAs to also cover decentralized cryptocurrencies. While there is a general consensus among regulators in Moscow against the free circulation of bitcoin in the country, the government is considering legalizing crypto payments in international settlements.

Sber intends to expand the DFA product line in the future in order to attract more corporate clients to its blockchain platform. According to an earlier statement by Vedyakhin, the bank also plans to allow individuals to use the blockchain for digital asset transactions in the spring of 2023.

Do you think more Russian companies will start tokenizing various assets in the future? Tell us in the comments section below.

from Bitcoin News https://ift.tt/thxZso8

via IFTTT

Krugman Compares Tesla Stock to Bitcoin, Takes Aim at Elon Musk

Submitted December 28, 2022 at 10:44PM by JERMYNC https://ift.tt/caRbQY9 https://ift.tt/dTIfFQ2

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/iF9d2Rf

via IFTTT

Bitcoin Foundation chairman: This isn't a fundamental problem with decentralization

from Google Alert - Bitcoin https://www.youtube.com/watch?v=0JkW3_rEdlw

Please give me a hit of hopium!

It’s been nothing but lower and lower red for the last 12 months.

I’ve been in since 2018 so this isn’t my first bear, but I’m getting to the point now where my interest in crypto is disappearing. Im even considering pausing all my future investing (which I know deep down this is the absolute opposite of what I should be doing right now)

I’m starting to lose faith in crypto! What if all the money I’ve sunk in over the last 5 years was a waste?

What if 2020-2022 was a total fluke and we never see the ATHs again due to lack of cheap money available thanks to the pandemic? Will I even break even once again?

What if the thing I’ve been putting my faith in, will spiral down into nothing???? What is crypto becomes the financial laughing stock?

Yes, I’m still continuing my DCA but I’m beginning to run out of hope that this crypto thing is the best move for my, and our, future.

People are saying one more capitulation, but crypto has already had so much bad news in 2022, I don’t want to see it get worse.

Please give me hopium!

Tap it to my veins!

I need it to help me get through this bear market….

Submitted December 28, 2022 at 11:16PM by Missmilster https://ift.tt/kcR7IiU https://ift.tt/dTIfFQ2

Bitcoin Could See Another Bull Rally If This Happens - NewsBTC

from Google Alert - Bitcoin https://ift.tt/HXphDeG

Krugman Compares Tesla Stock to Bitcoin, Takes Aim at Elon Musk

Submitted December 28, 2022 at 10:44PM by JERMYNC https://ift.tt/caRbQY9 https://ift.tt/dTIfFQ2

Wednesday, December 28, 2022

SBF borrowed $546M from Alameda to fund Robinhood share purchase

Submitted December 27, 2022 at 10:37PM by z0uNdz https://ift.tt/3jbdopH https://ift.tt/xwVslOg

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/0j6DhFR

via IFTTT

busd forsage io download 2023. ( accwallet.com )Claimable Airdrop ETH ERC20Wallet ...

from Google Alert - Bitcoin https://ift.tt/cTnh9sB

Venezuelan Banks Have Blocked Over 75 Accounts Since the End of Last Year Due to Cryptocurrency-Related Activities

Venezuelan Banks have started eyeing the accounts of customers with ties to cryptocurrency trading, principally related to peer-to-peer (P2P) transaction activity. According to Legalrocks, a crypto and blockchain-focused legal firm in Venezuela, more than 75 accounts have been blocked by Venezuelan private banks for facilitating crypto-to-fiat and fiat-to-crypto conversions since the end of 2021.

Venezuelan Banks Suspend Crypto-Related Accounts

Venezuelan banks are ramping up vigilance on accounts that commonly are related to cryptocurrency transactions. According to a blog post published by Legalrocks, a Venezuelan law firm focused on cryptocurrency and blockchain, more than 75 cases of accounts that have been suspended or are under investigation have been registered since the end of 2021.

Ana Ojeda, CEO of Legalrocks, states that using these accounts to receive fiat currency for a sale or exchange for cryptocurrency should not be considered a valid reason for blocking them. However, she clarifies that this changes if there are sufficient signs that the funds used in these transactions are related to illegal or criminal activities.

In the same way, transactions going through cryptocurrency exchanges not authorized by Sunacrip, the national superintendency for cryptocurrency assets, could also be considered suspicious by financial authorities, and justify an investigation.

Stablecoin Love

Ojeda explains that stablecoin exchanges through P2P markets are common due to the economic debacle and the high levels of devaluation that the national fiat currency (the Venezuelan bolivar) has experienced during this year. This means that people use stablecoins as a store of value, purchasing them when receiving fiat currency as payment and then exchanging them for fiat currency again to purchase goods and pay for services.

According to a report presented by the United Nations in July, Venezuela ranks third among the countries with the most cryptocurrency adoption.

According to Ojeda:

Venezuela has been leading the region for several years as the Latam country that uses cryptocurrencies the most to protect itself against inflation and the loss of savings capacity.

Stablecoin-based P2P markets have become so popular and extensive in Venezuela that some analysts believe they could be playing an important role in the dynamics of the U.S. dollar-bolivar exchange rate. In November, when the bolivar fell 40% against the U.S. dollar, economist Asdrubal Oliveros mentioned the interplay of crypto markets and the greater economy, along with the FTX collapse and the fear of holding funds on custodial exchanges, as a possible cause.

What do you think about Venezuelan Banks suspending or investigating crypto-related accounts? Tell us in the comments section below.

from Bitcoin News https://ift.tt/xGB3c82

via IFTTT

Collection online poker bitcoin. Betkings66.com . poker online flash ... - Side Project Brewing

from Google Alert - Bitcoin https://ift.tt/75TaHBg

SBF borrowed $546M from Alameda to fund Robinhood share purchase

Submitted December 27, 2022 at 10:37PM by z0uNdz https://ift.tt/3jbdopH https://ift.tt/xwVslOg

Tuesday, December 27, 2022

What are your crypto related new year's resolutions?

New year approaching fast, and curious what your new year's resolutions are.

For me, I cannot deny that crypto has impacted my sleeping habits, which were distinctly average before entering crypto, and have deteriorated since. Checking charts and this place at night/first thing in the morning is probably not the healthiest habit. I also wake up during night, which doesn't help...

Therefore, my new year's resolution is to be disciplined and get more high quality sleep. Put my phone out of reach a few hours before going to bed, and try to create new habits where I complete some tasks upon waking up instead of checking everything.

Bonus tip for others who are having trouble sleeping: I suspected that I have minor sleep apnea. Got myself some of those nose plaster things a few weeks ago that help open up your airways. Suddenly I'm dreaming again, or at least I remember dreaming, which I haven't in ages. Also waking up less throughout the night.

Submitted December 27, 2022 at 01:10AM by CatBoy191114 https://ift.tt/ovUNHA6 https://ift.tt/XMixCk2

Report: R&B Artist Akon Denies Claims His Crypto City Dream Is Crumbling

Senegalese-American artist, Akon, reportedly reassured participants in his so-called token of appreciation (TOA) that they will be reimbursed for donations. To back this promise, the singer reportedly claimed he is even willing to do “a world tour just to pay them all back.” Akon, however, conceded during an interview that he should “have gotten more things in place before promoting it [Akon City].”

Singer Ready to Do a World Tour for Token Holders

Rhythm and blues (R&B) singer and music producer, Akon, reportedly promised to reimburse disillusioned supporters who have been waiting for refunds from his token of appreciation (TOA) campaign. The Senegalese-American artist also told TOA holders that he is prepared to use his own funds to ensure this promise is honored.

“I’m dead serious. I would do a world tour just to pay them all back,” the award-winning artist reportedly said.

Launched in 2019, Akon’s TOA was given to his early financial backers. The TOA was not only a precursor to the akoin cryptocurrency but it also reportedly gave supporters an opportunity to acquire the crypto. However, after more than two years of waiting, some early backers have lost faith and are now asking for refunds.

Although he seemingly acknowledged that some supporters have lost faith in the project, Akon suggested during an interview with the BBC that his ambitious but much-delayed mega-construction project — Akon City — is still on track. As reported by Bitcoin.com News, construction of the initial phase of the singer’s “futuristic cryptocurrency-themed city” was expected to commence sometime in the second half of 2020.

Following the announcement of the singer’s reported multibillion-dollar project, Akon’s team revealed that the initial phase, which included the construction of hotels, a school, a waste facility, and a solar power plant, would be complete by the end of 2023. However, according to the BBC report, the site of Akon’s mega city has now become grazing land for goats.

Akon City Dream Still Alive

During the interview, Akon — who blames the Covid-19 pandemic for causing the delay — conceded that he should “have gotten more things in place before promoting it.” The singer is nevertheless adamant that his project, which has been “co-signed by the current [Senegalese] president” is still alive.

“I plan to retire in that city. I don’t like to use the word the king of the city. But that’s what it will turn out to be,” Akon reportedly said.

During the interview, the R&B singer was also asked to respond to investor concerns about the legality of using a cryptocurrency in a jurisdiction regulated by the Central Bank of West African States (BCEAO). He said.

I want to make sure that however we involve crypto within the city is in a way that it lines up with all the rules and regulations.

As explained in the BBC report, the BCEAO has not only warned of the dangers of using crypto but has reportedly called it illegal.

Meanwhile, when asked if the akoin cryptocurrency is still the preferred medium of exchange in the envisaged city, Akon promised to have this “figured out by the time the city’s up, that’s for sure.”

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.

from Bitcoin News https://ift.tt/HYKAjvk

via IFTTT

Community slams NYT for its latest 'sympathy piece' on FTX's Bankman-Fried

Submitted December 27, 2022 at 12:16AM by LazyEfficiency7942 https://ift.tt/jJh6pNO https://ift.tt/XMixCk2

Bitcoin Gold usdt tradingview converter coingecko 2023 2025. (➡️accwallet.com ... - Saint Bernard

from Google Alert - Bitcoin https://ift.tt/tYam9Fs

Robocallers have upped their scam game and they’re after your crypto

Submitted December 26, 2022 at 07:37PM by Nawbz https://ift.tt/K4kprfz https://ift.tt/XMixCk2

Monday, December 26, 2022

Argentine Peso Plunges to a 5 Month Low Amid Legal and Political Woes

The Argentine Peso has experienced a sudden fall vs the U.S. dollar, falling to a 5-month low in its blue rate, one of the many parallel exchange rates of the country. The reasons for this fall, besides the abundance of pesos due to holiday-related payments, and the battle between President Alberto Fernandez and Argentine courts.

Argentine Peso Falls Sharply Against the US Dollar

The Argentine peso is facing a sudden downturn that has taken the value of the currency to historic lows. On Dec. 23, local media informed one of the informal exchange rates of the currency vs the U.S. dollar, denominated “blue dollar,” had reached the 340 pesos mark. This marks a 5-month low after a period in which the peso maintained its value relatively steady.

The last time that the peso plunged in this way was in July when the country was also submerged in a period of political instability with the resignation of Finance Minister Martin Guzman. The historical minimum exchange rate is 350 pesos per U.S. dollar, reached in June.

Analysts have proposed several explanations for this situation, including the occurrence of the holiday seasons when more pesos are in the street and Argentines run to hedge their savings in foreign currency. However, other political factors are also present at this time.

Political and Financial Instability

President Alberto Fernandez decided to ignore a decision taken by the maximum justice tribunal of the country, that would give a bigger percentage to the city of Buenos Aires from taxes collected at a provincial level. The tribunal ordered the national government to deliver 2.95% of these taxes to the city on Dec. 21.

This has spurred a climate of legal uncertainty that, according to some analysts, is affecting the value of the Argentine peso, and will continue to affect it in the future. This decision lifts worries on other flanks too, former Finance secretary Miguel Kiguel explains. He stated:

It is logical that questions arise about the fulfillment of the contracts. If the Government does not comply with the ruling of the Supreme Court, the question of what is fulfilled and what is not opens.

This battle affects the credibility and investors in the country must also hedge their savings in U.S. dollars, which in turn causes these sudden disruptions in the exchange rate. Venezuela is another country that is also facing severe difficulties with its fiat currency, which has reached an exchange rate of almost 18 bolivares per U.S. dollar, one of the highest in its history.

What do you think about the recent behavior of the U.S. dollar- Argentine peso exchange rate and the causes behind it? Tell us in the comments section below.

from Bitcoin News https://ift.tt/hcESqMn

via IFTTT

Search for NFT Art - SuperRare

from Google Alert - Bitcoin https://ift.tt/siEVvZ1

Search results for: 'online bitcoin blackjack trust dice. Betkings66.com ... - CraftOutlet.com

from Google Alert - Bitcoin https://ift.tt/kPBoZD2

I grew my cryptocurrency portfolio by 8 times. Then I blew it on a scam

Submitted December 25, 2022 at 11:45PM by jimtors100 https://ift.tt/0s8yMvm https://ift.tt/E1PgwMC

What if we get another bull run, but there isn't another all time high for crypto?

Seeing a lot of posts/comments about current bear market, next bull run, next ATH, and everything in between.

I'm not saying this will happen but what if there isn't another all time high?

The environment during the previous run seemed almost too perfect for speculative assets: low interest rates, high stimulus, people around the world locked down, working from home/remotely, excess savings etc..

Global macro is not looking good, and it might even get worse next year and beyond. However as certain as the sun rising and setting, we'll see markets and economies cycle through to growth eventually.

Keen to hear what you all think?

Submitted December 25, 2022 at 10:30PM by danske11 https://ift.tt/X72w1on https://ift.tt/E1PgwMC

Sunday, December 25, 2022

Mark Cuban defends Bitcoin, says anyone investing in gold is ‘dumb as f***’

Submitted December 24, 2022 at 10:41PM by PillarOfJustice https://ift.tt/LFyOnAK https://ift.tt/tf4odSj

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/epFvHwh

via IFTTT

Bitcoin Price Prediction – Can BTC Hit a New All-Time High in 2023? - Crypto News

from Google Alert - Bitcoin https://ift.tt/Zsxb7HP

Russia to Ban Banks From Using Messengers Like Telegram to Contact Customers

Financial institutions in Russia will not be able to communicate with clients through instant messengers based outside the country, local media revealed. A new law passed by the State Duma also prohibits banks from using chats to send personal data and payment documents.

Bill Restricts Russian Banks and Brokers From Sending Sensitive Information Through Foreign Messengers

Banks in the Russian Federation will not be allowed to contact their customers on a number of popular messengers, according to new legislation approved by the lower house of parliament. The ban applies to foreign-based platforms.

A list of the affected apps is yet to be published by Roskomnadzor, the Federal Service for Supervision of Communications, Information Technology and Mass Media, but Telegram, Whatsapp, Viber, and the like fit the description, the business daily Kommersant reported.

The draft law, passed by the State Duma in the third reading, also restricts the use of this type of messaging service for correspondence containing sensitive information like personal data or documents related to payments and money transfers.

The restrictions concern not only banks but all other financial organizations as well, including brokers, companies operating in the securities market, management firms, investment funds, and private pension funds and depositories, the article details.

Digital Development Ministry to Oversee the Implementation of the New Restrictions

According to Anatoly Aksakov, head of the parliamentary Financial Market Committee, the Russian Ministry of Digital Development, Communications and Mass Media will be tasked to oversee the ban, not the Central Bank of Russia in this case. Commenting for Kommersant, he also stated:

Credit organizations, of course, are very careful about the implementation of the law, and are unlikely to violate it. Therefore, obviously, they will take steps to avoid falling under sanctions.

Speaking to the newspaper, members of the industry noted that instant messengers are rarely used to communicate with clients, especially by large players who have developed their own applications featuring built-in support chats.

Others employ third-party solutions, most often secure platforms for communicating with clients, exchanging documents, concluding agreements, uploading data, and reporting to the central bank, explained Tatyana Evdokimova, an investment advisor. “We know what personal data protection is, and we have been complying with certain requirements for a long time,” she emphasized.

Do you think the ban will affect the daily operations of banks and other financial institutions in Russia? Share your thoughts on the subject in the comments section below.

from Bitcoin News https://ift.tt/SqAXPvQ

via IFTTT

When you tell r/IRS that bitcoin is beyond seizure. - Reddit

from Google Alert - Bitcoin https://ift.tt/ZxdAzNh

Mark Cuban defends Bitcoin, says anyone investing in gold is ‘dumb as f***’

Submitted December 24, 2022 at 10:41PM by PillarOfJustice https://ift.tt/LFyOnAK https://ift.tt/tf4odSj

Saturday, December 24, 2022

Russian Parliament Postpones Adoption of Crypto Mining Bill

Russian lawmakers will consider a draft law on cryptocurrency mining in 2023 despite earlier indications they were going to vote on the proposal in December. The bill is expected to set the rules for the extraction and sale of cryptocurrency in Russia amid sanctions limiting the country’s access to global finances and markets.

Russia’s New Crypto Mining Legislation Is Yet to Be Fully Approved

Members of the State Duma will review and vote on the draft law designed to legalize cryptocurrency mining in the Russian Federation in 2023, the head of the Financial Market Committee Anatoly Aksakov announced in comments for the crypto section of the business news portal RBC.

The high-ranking lawmaker, who has been closely involved in efforts to regulate Russia’s crypto space, explained that the proposed legislation needs additional approvals. He was likely referring to the reconciliation of the positions of the various regulators involved in the process.

The bill, which was submitted to the lower house of Russian parliament in November, introduces amendments to the existing law “On Digital Financial Assets.” The latter went into force in January of 2021 and only partially regulated crypto-related activities.

Mining, for which Russia has certain competitive advantages like low-cost power and a cool climate, has been expanding as an industry and spreading as an additional income source for many amateur miners, especially in the country’s energy-rich regions.

Throughout this year, Russian government institutions have been mulling over how to expand the current regulatory framework to cover operations with cryptocurrencies. While most officials remain opposed to allowing the free circulation of bitcoin and the like inside Russia, their use in cross-border payments amid financial restrictions imposed over the war in Ukraine has gained significant support. Sanctions have affected the mining sector, too.

The mining law was initially rejected by the legal department of the Duma which insisted that the draft should first be coordinated with the Bank of Russia. The central bank, which has maintained a hardline stance on crypto, later supported the document under the condition that the minted coins will either be sold abroad or exchanged to fiat only under special legal regimes in Russia.

In mid-December, Aksakov’s committee considered the bill and proposed its adoption on first reading before the end of the fall session. The establishment of the “experimental legal regimes” proposed by the Bank of Russia should be regulated with a separate bill which also had to be filed with the Duma this year. Aksakov added that this piece of legislation needs to be approved as well.

Do you think Russia will expedite the adoption of its crypto mining bill in 2023? Share your expectations in the comments section below.

from Bitcoin News https://ift.tt/AQbEDig

via IFTTT

Samsung Is Investing More Than $35 Million in Latam-Focused Metaverse Initiatives

Samsung, the Korean electronics behemoth, has revealed it is currently investing more than $35 million dollars in metaverse initiatives for the Latam audience. The objective behind this move is to help the brand attract and connect with younger audiences, as part of its digital push and growth marketing strategy.

Samsung’s Metaverse Push in Latam

Many companies have started to put their products and their brands in the metaverse, considering it an important part of their marketing strategy. Samsung, one of the biggest electronics companies in the world, has recently revealed it is investing more than $35 million in metaverse initiatives directed at Latam customers.

In an article published on Dec. 20, Anita Caerols, director of marketing and corporate citizenship of Samsung Electronics Chile, explains the motivations behind this virtual reality push for the company. She stated:

At Samsung we believe that the metaverse is a concrete commitment to connect with young consumers. That is why we are investing more than US$35 million in initiatives that cover all of Latam.

Furthermore, Caerols believes that fully immersive platforms are part of the future of marketing and that for digital natives, the current metaverse is a natural extension of social media platforms, making it a sensible field for Samsung to explore.

Younger Audiences in the Scope

The focus Samsung is putting on the metaverse, and the amount of funds invested in this area, are justified by the marketing vision presented by the company. On this, Caerols explained:

If a business needs to speak and connect with young audiences, prospect current and future potential consumers, and engage with new influencers, it is imperative that it be in the metaverse starting now.

It is Gen Z and Gen Alpha, audiences that are more accustomed to these platforms, which are the ones Samsung wants to attract to its proposal and its products. According to a Linkedin study, 400 million users are currently dwelling on metaverse platforms every month, with 51% of them being 13 years old or less.

Samsung’s interest in the virtual world is not new, and the company has already made different moves in order to be a part of some metaverse platforms.

In October, the company launched its “House of Sam” experience in Decentraland, allowing users to interact virtually with products of the company.

In July, Samsung also launched another metaverse experience on Roblox, called “Space Tycoon,” allowing users to be part of a space station where they can build Samsung products with raw materials.

What do you think about Samsung’s investments in Latam metaverse initiatives? Tell us in the comments section below.

from Bitcoin News https://ift.tt/3gpcQe9

via IFTTT

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/0lk8uQP

via IFTTT

Ignore the Clickbait News Articles: What SBF's Bail Means and Should He be Out on Bail

The judge in SBF's case chose to make a statement by making his bail $250,000,000. This huge bail amount generated many clickbait news articles, most of which focus on the bail amount and ignore how the US pre-trial detention system works.

Getting Bail

In the US justice system, you will likely be given the opportunity for bail prior to your trial. Bail is often denied if you have committed a violent crime (this is self-explanatory). It is also frequently denied if you are deemed a flight risk. SBF had access to his passport before he was arrested in the Bahamas and has shown he is a low-flight risk.

SBF did not get special treatment in getting offered bail.

$250,000,000 Bail

It does not matter if the judge put bail at $25 million or $250 million. The system works the same.

Typically the defendant, friends of the defendant, and family of the defendant put assets worth $1-5 million as collateral and co-sign the bond. The people that co-sign the bond are responsible for it should the defendant default on it. The most common assets put up for collateral are houses, then retirement accounts, then cash.

The judge is making a statement by putting the bail at $250 million. He is drawing more public attention to himself and the case. There is no functional reason to make the bail $250 million vs $25 million.

SBF's parents put their ~$4 million house as collateral and co-signed the bond. SBF did not get special treatment

FTX money was used to buy the house his parents put up for collateral

SBF's parents bought the house in 1992 for $700,000, the same year that SBF was born. FTX money was not used to purchase this house. Now, there might be other homes that are in SBF's father's name that were purchased with FTX money, but not this one.

The US criminal justice system is set up so that if you have money or have a family that has money, you will spend minimal time in jail before your trial (often a very different story than if you are poor). SBF's experience with bail is typical if you can post $1 million+ in collateral. It does not mean he will not spend a long time in jail. Having 2 people already flip and plead guilty shows that the US government is serious about getting a conviction for SBF.

Submitted December 23, 2022 at 09:39PM by pbjclimbing https://ift.tt/e8vJXxl https://ift.tt/fQ2SDvl

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/shZlz5c

via IFTTT

Why Famed Value Investor Bill Miller Is Still Bullish on Bitcoin, Amazon Stock, and More

from Google Alert - Bitcoin https://ift.tt/RcLGJSV

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/DAFikdI

via IFTTT

Bitcoin SV wallet metamask 2023. (➡️accwallet.com⬅️)Claimable Airdrop ETH ...

from Google Alert - Bitcoin https://ift.tt/UGYKhev

Samsung Is Investing More Than $35 Million in Latam-Focused Metaverse Initiatives

Samsung, the Korean electronics behemoth, has revealed it is currently investing more than $35 million dollars in metaverse initiatives for the Latam audience. The objective behind this move is to help the brand attract and connect with younger audiences, as part of its digital push and growth marketing strategy.

Samsung’s Metaverse Push in Latam

Many companies have started to put their products and their brands in the metaverse, considering it an important part of their marketing strategy. Samsung, one of the biggest electronics companies in the world, has recently revealed it is investing more than $35 million in metaverse initiatives directed at Latam customers.

In an article published on Dec. 20, Anita Caerols, director of marketing and corporate citizenship of Samsung Electronics Chile, explains the motivations behind this virtual reality push for the company. She stated:

At Samsung we believe that the metaverse is a concrete commitment to connect with young consumers. That is why we are investing more than US$35 million in initiatives that cover all of Latam.

Furthermore, Caerols believes that fully immersive platforms are part of the future of marketing and that for digital natives, the current metaverse is a natural extension of social media platforms, making it a sensible field for Samsung to explore.

Younger Audiences in the Scope

The focus Samsung is putting on the metaverse, and the amount of funds invested in this area, are justified by the marketing vision presented by the company. On this, Caerols explained:

If a business needs to speak and connect with young audiences, prospect current and future potential consumers, and engage with new influencers, it is imperative that it be in the metaverse starting now.

It is Gen Z and Gen Alpha, audiences that are more accustomed to these platforms, which are the ones Samsung wants to attract to its proposal and its products. According to a Linkedin study, 400 million users are currently dwelling on metaverse platforms every month, with 51% of them being 13 years old or less.

Samsung’s interest in the virtual world is not new, and the company has already made different moves in order to be a part of some metaverse platforms.

In October, the company launched its “House of Sam” experience in Decentraland, allowing users to interact virtually with products of the company.

In July, Samsung also launched another metaverse experience on Roblox, called “Space Tycoon,” allowing users to be part of a space station where they can build Samsung products with raw materials.

What do you think about Samsung’s investments in Latam metaverse initiatives? Tell us in the comments section below.

from Bitcoin News https://ift.tt/3gpcQe9

via IFTTT

Ignore the Clickbait News Articles: What SBF's Bail Means and Should He be Out on Bail

The judge in SBF's case chose to make a statement by making his bail $250,000,000. This huge bail amount generated many clickbait news articles, most of which focus on the bail amount and ignore how the US pre-trial detention system works.

Getting Bail

In the US justice system, you will likely be given the opportunity for bail prior to your trial. Bail is often denied if you have committed a violent crime (this is self-explanatory). It is also frequently denied if you are deemed a flight risk. SBF had access to his passport before he was arrested in the Bahamas and has shown he is a low-flight risk.

SBF did not get special treatment in getting offered bail.

$250,000,000 Bail

It does not matter if the judge put bail at $25 million or $250 million. The system works the same.

Typically the defendant, friends of the defendant, and family of the defendant put assets worth $1-5 million as collateral and co-sign the bond. The people that co-sign the bond are responsible for it should the defendant default on it. The most common assets put up for collateral are houses, then retirement accounts, then cash.

The judge is making a statement by putting the bail at $250 million. He is drawing more public attention to himself and the case. There is no functional reason to make the bail $250 million vs $25 million.

SBF's parents put their ~$4 million house as collateral and co-signed the bond. SBF did not get special treatment

FTX money was used to buy the house his parents put up for collateral

SBF's parents bought the house in 1992 for $700,000, the same year that SBF was born. FTX money was not used to purchase this house. Now, there might be other homes that are in SBF's father's name that were purchased with FTX money, but not this one.

The US criminal justice system is set up so that if you have money or have a family that has money, you will spend minimal time in jail before your trial (often a very different story than if you are poor). SBF's experience with bail is typical if you can post $1 million+ in collateral. It does not mean he will not spend a long time in jail. Having 2 people already flip and plead guilty shows that the US government is serious about getting a conviction for SBF.

Submitted December 23, 2022 at 09:39PM by pbjclimbing https://ift.tt/e8vJXxl https://ift.tt/fQ2SDvl

Why Famed Value Investor Bill Miller Is Still Bullish on Bitcoin, Amazon Stock, and More

from Google Alert - Bitcoin https://ift.tt/RcLGJSV

Friday, December 23, 2022

bitcoin busd nedir 2023. ( accwallet.com )Claimable Airdrop ETH ERC20Wallet. shib ...

from Google Alert - Bitcoin https://ift.tt/NCK653a

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/gxhBUA4

via IFTTT

Back to Bitcoin: A Look Back at 2022 | Alexandria - CoinMarketCap

from Google Alert - Bitcoin https://ift.tt/akOzRfi

FTX Case May Bring SEC One Step Closer To Banning Crypto Exchanges

Submitted December 23, 2022 at 01:06AM by TheRock_0001 https://ift.tt/hzZO5xB https://ift.tt/gYUb5li

Buenos Aires to Tax Cryptocurrency Mining in 2023

The province of Buenos Aires in Argentina will begin taxing cryptocurrency mining and possibly staking, in 2023. A new proposal modifies the tax law to introduce cryptocurrency mining as a taxable activity that will levy 4% on the income calculated via these operations. However, it is still unclear if staking will be taxed.

Buenos Aires Adds Cryptocurrency Mining as Taxable Activity

The province of Buenos Aires in Argentina approved a project to add cryptocurrency mining as a taxable activity for the next year. A document, presented by the governor of the province, Alex Kicillof, establishes that the activity formally described as “Processing and validation services for crypto assets and/or cryptocurrency transactions (crypto asset and/or cryptocurrency mining)” will require a 4% aliquot over income produced in these operations.

The taxes would be paid to the government of the province, and would not be related to any other taxes established by the Argentine national government. The document further clarifies that this tax will apply only when the hardware used to deploy this activity is located in the province’s jurisdiction.

This tax regime will begin to be applied in January, but there are still some elements undefined around the implementation of this new tax.

Doubts Remain

The doubts that analysts have about the application of this tax are related mainly to two areas. The first one has to do with the definition of the equipment that will be taxed. If the approved documents refer only to proof-of-work hardware, only ASIC miners and graphic cards will be considered for these taxes. However, if computers running staking nodes are also considered part of this hardware, staking could also be taxed.

Further, Marcos Zocaro, an Argentine accountant, has questions about the price at which the mined (or staked) cryptocurrencies will be taxed. The document states that these crypto assets will be taxed at “official or current value in place,” but fails to define the source of these values that vary from exchange to exchange. It is also unclear if this value will be calculated when the cryptocurrency is mined, or when the tax period is finished.

In April, Buenos Aires announced it would allow users to pay taxes with crypto this next year. The city also has a project to use a blockchain ID system and will host Ethereum nodes as part of its digitization and modernization push in 2023.

What do you think about the new taxes that Buenos Aires will apply to cryptocurrency mining? Tell us in the comments section below.

from Bitcoin News https://ift.tt/O3gqAxy

via IFTTT

SEC General Counsel Quits After 'Cozy Relationship' With SBF and FTX

Submitted December 22, 2022 at 11:59PM by economist_kinda https://ift.tt/ZGpi837 https://ift.tt/gYUb5li

bitcoin busd nedir 2023. ( accwallet.com )Claimable Airdrop ETH ERC20Wallet. shib ...

from Google Alert - Bitcoin https://ift.tt/NCK653a

Thursday, December 22, 2022

US Lawmaker: Crypto Self-Custody Is Antidote to FTX Fraud — 'Keep Your Coins Act' Will Protect Self-Hosted Wallets

Submitted December 21, 2022 at 11:54PM by Wabi-Sabibitch https://ift.tt/0BJrU6q https://ift.tt/bp6j1HU

Defi More Scalable Than Traditional Finance, New Study Says

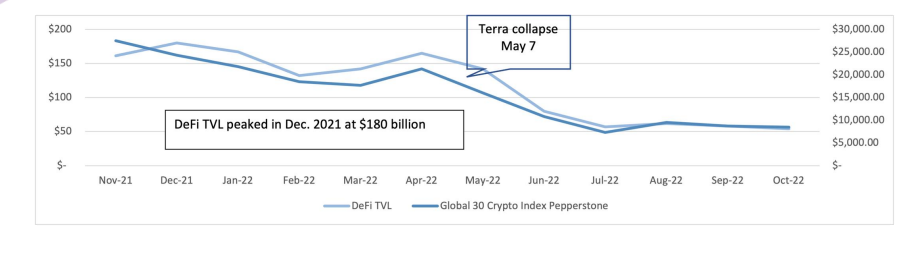

Despite the market conditions that prevailed in much of 2022, decentralized finance (defi) still demonstrated its greater scaling potential than that of the traditional financial industry, a new report has said. Even though the total value locked dropped from the peak of $180 billion in Dec. 2021, to just over $50 billion by end of Oct. 2022, certain sectors of the defi market still “show a very optimistic trend.”

Decline in Total Value Locked

According to Hashkey Capital’s end-of-year report, decentralized finance (defi) has the “potential to be many times more scalable than the traditional financial industry.” In addition to the scaling potential, defi protocols are resilient and are likely to emerge from black swan events such as the Terra luna/UST collapse unscathed, the report suggested.

However, in the report titled Defi Ecosystem Landscape Report, Hashkey Capital — an end-to-end digital asset financial services group — acknowledged that unfavorable market conditions that largely prevailed in 2022 had contributed to the decline in the value of total assets under management.

“The decline of the TVL – Total Value Locked (a proxy for total assets under management in Defi) – was also motivated by the general market conditions. Lower crypto prices (due to generally unfavourable macro) mean that the value of the collaterals provided in Defi lending is also lower, reducing the motivation to get a loan against those collaterals. DEX [decentralized exchange] activity and crypto trading volumes are also lower,” the report said.

As shown by the report’s data, the TVL, which peaked at $180 billion in Dec. 2021, dropped from just under the $150 billion seen around May 2022, to just over $50 billion in late October. Despite this TVL decline, according to the report, certain sectors of the defi market still “show a very optimistic trend.”

Defi Growth Slowdown

Concerning the extent of adoption, the report acknowledges that there has been a slowdown in the growth rate in 2022 (31%) when compared to 2021 (545%). Remarking on this outcome, as well as the rise in number of wallets to over 5 million, the report said:

2022 can be seen as a year of consolidation where most projects are busy building and improving their products rather than spending their resources on marketing activities. 2022 is also the year when the UI and user experience of Defi protocols improved significantly, to a level that we can finally say that it’s easier to use some Defi protocols than using a home banking app.

According to the report, a large chunk of support for Defi protocols came from venture capital (VC) firms which poured “$14 billion into 725 crypto projects (many of those are Defi)” in the first half of 2022.

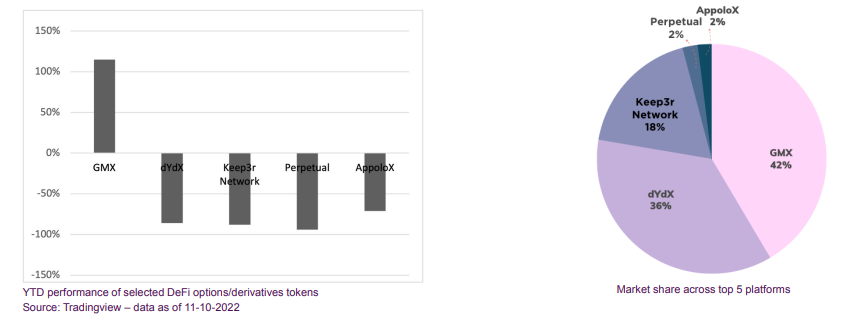

On the likely trigger of the next defi summer, the report points to the derivatives and options sector where key platforms like GMX saw a “substantial growth in the number of users and TVL.” From the TVL of $108 million at the start of 2022, GMX saw this value grow to $480 million by the end of October. Another platform, Dydx, which saw the price of its token drop by 90% in one year, “earned over $50 million in revenue and continues to have over 1000 weekly active users.”

What are your thoughts on this story? Let us know what you think in the comments section below.

from Bitcoin News https://ift.tt/J0zemIh

via IFTTT

CCIP-046 - Increase Comedy flair posts from 2 to 4

2 months ago, CCIP-040 made 2 changes:

- Comedy flair posts will not count towards limiting the number of posts allowed per token in the top 50 posts.

- Instead, Comedy flair posts will have their own limit of just two.

If you read the comments in original poll, a lot of people liked the 1st half of the change, but they expressed concerns about the 2nd half because 2 is a very low limit.

I think it was a drastic change and that we went overboard. I propose to relax the limit from 2 to 4.

Reasons to increase the limit to 4:

- No other category flair has such a limit. The rest of the limits are all for coin topics. It's way too easy to hit the 2-post limit, and we're constantly hitting it.

- Comedy posts allow people to vent through humor, and those posts are only being rewarded with a 0.1x Moons multiplier anyways.

- It's the bear market. We could use a little more comedy.

- One large benefit of Comedy posts is that they act as a honeypot for non-serious posts and comments. Now all that pent-up comedy energy is being redirected as low-effort comments in other posts. I personally like the comedy flair because I could selectively filter them out if I didn't want to read any.

- In the original poll, most people were voting in favor because they really liked the 1st half, not the limit of 2.

Submitted December 21, 2022 at 09:39PM by Maleficent_Plankton https://ift.tt/nyETGlC https://ift.tt/bp6j1HU

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/CPy1XsY

via IFTTT

Twitter quietly adds BTC and ETH price indexes to search function

Submitted December 21, 2022 at 08:04PM by adoxxvegas https://ift.tt/Xl7V2ab https://ift.tt/bp6j1HU

What is a Bitcoin wallet? – The Ultimate Beginner's Guide – Investment – Stock Funds

from Google Alert - Bitcoin https://ift.tt/RvbG7DB

CCIP-046 - Increase Comedy flair posts from 2 to 4

2 months ago, CCIP-040 made 2 changes:

- Comedy flair posts will not count towards limiting the number of posts allowed per token in the top 50 posts.

- Instead, Comedy flair posts will have their own limit of just two.

If you read the comments in original poll, a lot of people liked the 1st half of the change, but they expressed concerns about the 2nd half because 2 is a very low limit.

I think it was a drastic change and that we went overboard. I propose to relax the limit from 2 to 4.

Reasons to increase the limit to 4:

- No other category flair has such a limit. The rest of the limits are all for coin topics. It's way too easy to hit the 2-post limit, and we're constantly hitting it.

- Comedy posts allow people to vent through humor, and those posts are only being rewarded with a 0.1x Moons multiplier anyways.

- It's the bear market. We could use a little more comedy.

- One large benefit of Comedy posts is that they act as a honeypot for non-serious posts and comments. Now all that pent-up comedy energy is being redirected as low-effort comments in other posts. I personally like the comedy flair because I could selectively filter them out if I didn't want to read any.

- In the original poll, most people were voting in favor because they really liked the 1st half, not the limit of 2.

Submitted December 21, 2022 at 09:39PM by Maleficent_Plankton https://ift.tt/nyETGlC https://ift.tt/bp6j1HU

Wednesday, December 21, 2022

BTC-e’s Alexander Vinnik Applies for Release on Bail Citing Trial Delay

The alleged operator of crypto exchange BTC-e, Alexander Vinnik, has asked to be released on bail due to the delay in court proceedings. In early August, the Russian IT specialist was extradited to the United States to face charges of money laundering through the now-defunct coin trading platform.

Vinnik’s Defense Appeals for His Release on Bail After Months in U.S. Custody

Crypto entrepreneur Alexander Vinnik has applied for release on bail because of the delay of his trial, according to Russian media. He has been in U.S. custody for over three months but the documents required by the court have not been provided by the respective American authorities, his lawyers have pointed out.

According to information published in the Northern District of California’s federal court documents database on Friday, Vinnik’s defense team is asking for all documents pertaining to the trial to be presented within 60 days.

Alexander Vinnik believes he should be released on bail or allowed to exercise the right to a speedy trial as the U.S. government has not fulfilled its obligations after promising to provide evidence in this case, the daily Izvestia unveiled in a report quoting the appeal.

The alleged operator of BTC-e was arrested in July 2017, while on vacation in Greece with his family. He was detained on a warrant issued by U.S. authorities who accuse him, among other crimes, of laundering between $4 billion and $9 billion through the crypto exchange.

Besides the U.S., the French judiciary also wanted his extradition and Greek authorities decided to first hand him over to France in 2019. After serving a sentence there, he was returned to Greece this past summer and extradited immediately to the United States. Both French and Greek authorities have ignored extradition requests submitted by Russia.

Vinnik appeared in San Francisco federal court on Aug. 5 maintaining his innocence. Later that month, Russian media reported that he had been denied release on bail, quoting his record on the website of the Santa Rita Jail in California where he was incarcerated.

In September, his French lawyer Frederic Belot urged the Russian government to consider Vinnik in a potential prisoner exchange deal with the U.S., pointing out that the maximum sentence for Vinnik’s charges, 55 years, would amount to imprisonment for life for the 43-year-old Russian. His health has been deteriorating after solitary confinement in France and hunger strikes in Greece.

Do you think Alexander Vinnik’s appeal for release on bail will be granted this time? Share your thoughts on the case in the comments section below.

from Bitcoin News https://ift.tt/HfJB4sA

via IFTTT

Looking through the top100 cryptos by marketcap, there are 10 coins/tokens that are at least 98% from the All Time High. Which (if any) of these do you think can survive?

Looking through the top100 cryptos by marketcap, there are 10 coins/tokens that are at least 98% from the All Time High. Which (if any) of these do you think can survive?

Paraphrasing from Animal Farm, everything is down, but some are more down than others. The following coins or tokens are down by 98% or more. In fact, after rounding, some are down by 100%. Assuming it is actually 99.9999 % or something, that is looking like a total loss.

These are just the cryptos still in the top 100. There is a lot more than 10 cryptos down by this much.

Here is the WATCHLIST OF SHAME for 2022.

- Internet Computer

- Filecoin

- Flow

- Terra Luna Classic

- ZCash

- The Graph

- Ethereum POW

- Curve Dao

- Casper

- NEM

I created a public watchlist on CMC if anyone wants to go take a look in more depth. Here's a screenshot for reference.

Top100 Down 98% or more (BTC included for reference)

So this begs the question, which, if any, of the above cryptos stands the most chance of survival?

************************************************

A TRULY DEGEN PLAY ?

Looking at this data another way, it could be a list of cryptos that offer the highest return potential. To return to their ATH, these prices have to increase ~5000%. That is an insane gain.

As a truly degenerate gamble, someone could buy all of ten these for $100 each. A $1000 investment. If just one of them returns to its ATH, your return is $5000.

Which one could it be?

Submitted December 20, 2022 at 05:42PM by gnarley_quinn https://ift.tt/pngXAsJ https://ift.tt/fWa376l

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/0IsnSoy

via IFTTT

Markets: Bitcoin rises, Ether gains on potential Visa integration, BNB rebounds

from Google Alert - Bitcoin https://ift.tt/9v4eAJB

Buy Gift Cards With Crypto on BuySellVouchers Gift Card Marketplace

PRESS RELEASE. The popular online gift card exchange BuySellVouchers now accepts Binance USD (BUSD) as payment. With thousands of customers and sellers worldwide, BuySellVouchers has become one of the most significant gift card marketplaces which accepts crypto payments. To further serve its diverse customer base, BuySellVouchers marketplace continues to add new cryptocurrencies.

E-Vouchers and e-Gift cards have grown in popularity as more and more people choose to do their shopping online. Recent events, like the COVID-19 outbreak, have accelerated the trend toward today’s enterprises’ widespread use of online platforms.

The gift card trading industry continues to grow, which is now worth millions of dollars. The problem is that many of these online marketplaces need more user-friendliness and a more accessible environment. This also applies to the variety of payment methods and the size of commissions.

With BUSD as a payment option, BuySellVouchers has provided its customers with a one-of-a-kind buying experience that combines affordability and adaptability.

Currently, you can pay with the following cryptocurrencies on the BuySellVouchers marketplace: Tether ERC20 (USDT), Tether TRC20 (USDT), Litecoin (LTC), Ethereum (ETH), Bitcoin (BTC), and Binance USD (BUSD). You can also pay with electronic money, such as: Perfect Money, Advcash and Webmoney.

If we continue to talk about the ease of use of the marketplace, then it is important to note that BuySellVouchers marketplace supports seven languages: English, Russian, German, Chinese, Spanish, French, and Arabic.

Gift card trading is possible in a wide variety of categories: VoIP, Gift cards, Games, Prepaid Vouchers, Download / File hosting services, Mobile recharge, Software, E-books, Restaurants, and Other.

Here you can buy and sell gift cards from Google Play, Apple iTunes, Apple App Store, Uber, Sephora, Ikea, Razer Gold, Roblox, Origin, Newegg, Nimbuzz, Rebvoice, Microsoft Windows, Skype, Netflix, Vanilla, Zalando, Openbucks, Azteco, CryptoVoucher, Binance, Free Fire, PlayerUnknown’s Battlegrounds, Apex Legends, IMO, Gpay, Alldebrid, PlayStation, Letitbit, Luminar, Xbox, SmileTV, Norton, Valorant, Fortnite, Nintendo, Noodle, T-mobile, Jawaker, Discord Nitro, GameStop, Mobile Legends, Vodafone, Blizzard, FIFA Coins and many others.

It’s no surprise that BuySellVouchers has gained in popularity; the site charges just 0.4% (for gift card buyers) and 0.3% (for gift card sellers). Plus, most of the gift cards found on the platform can be purchased at a discount (cheaper than the face value of the gift card). Gift cards may be sent instantly or manually on the platform, depending on the vendor and purchased item. As an added perk, BuySellVouchers provide a weekly gift card giveaway.

The registration process on the platform is simple and fast, you don’t need to enter credit card data to register. All you need is an email address.

Visit BuySellVouchers.com to learn more about the marketplace and how you can buy and sell gift cards there. It’s also widely dispersed on social media platforms like Facebook, YouTube, and Twitter.

About BuySellVouchers

BuySellVouchers.com is an online marketplace that has been operating since 2012. It has gained its popularity due to the low commission fees and the range of different payment methods. On the platform you can buy and sell gift cards, vouchers, gift certificates and various other digital products. Many official distributors sell their products on the BuySellVouchers marketplace, confirming their high-quality standards.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

from Bitcoin News https://ift.tt/NaMsQL5

via IFTTT

Looking through the top100 cryptos by marketcap, there are 10 coins/tokens that are at least 98% from the All Time High. Which (if any) of these do you think can survive?

Looking through the top100 cryptos by marketcap, there are 10 coins/tokens that are at least 98% from the All Time High. Which (if any) of these do you think can survive?

Paraphrasing from Animal Farm, everything is down, but some are more down than others. The following coins or tokens are down by 98% or more. In fact, after rounding, some are down by 100%. Assuming it is actually 99.9999 % or something, that is looking like a total loss.

These are just the cryptos still in the top 100. There is a lot more than 10 cryptos down by this much.

Here is the WATCHLIST OF SHAME for 2022.

- Internet Computer

- Filecoin

- Flow

- Terra Luna Classic

- ZCash

- The Graph

- Ethereum POW

- Curve Dao

- Casper

- NEM

I created a public watchlist on CMC if anyone wants to go take a look in more depth. Here's a screenshot for reference.

Top100 Down 98% or more (BTC included for reference)

So this begs the question, which, if any, of the above cryptos stands the most chance of survival?

************************************************

A TRULY DEGEN PLAY ?

Looking at this data another way, it could be a list of cryptos that offer the highest return potential. To return to their ATH, these prices have to increase ~5000%. That is an insane gain.

As a truly degenerate gamble, someone could buy all of ten these for $100 each. A $1000 investment. If just one of them returns to its ATH, your return is $5000.

Which one could it be?

Submitted December 20, 2022 at 05:42PM by gnarley_quinn https://ift.tt/pngXAsJ https://ift.tt/fWa376l

Featured Post

BITCOIN (BTC) blockch✂️ain FORKS

🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧 Bitcoin Cash: Forked at Block 478558, 1 August 2017, For each 1 BTC you get 1 BCH Bytether: Cross for...