There are so many benefits to using a cryptocurrency, that it would seem foolish to neglect such an invention. For example, it allows you to send money anywhere in the world in an instant, with basically no fees involved. Everyone can be included in the financial system, it will change the way we interact with money, it can prevent fraud, and much more.

Monday, November 30, 2020

Brazilian 'Phantom Investment' Cryptocurrency Ponzi Scammer Extradited to US

from #Bitcoinmovement https://ift.tt/37rjEOl

via IFTTT

Why is PayPal Starting to Accept Cryptocurrency?

from #Bitcoinmovement https://ift.tt/3qfnIJP

via IFTTT

Here's Why Cryptocurrency Stocks Are Soaring Today

from #Bitcoinmovement https://ift.tt/2VnpURv

via IFTTT

Cryptocurrency Exchanges Binance and Huobi to List

from #Bitcoinmovement https://ift.tt/3obPk0U

via IFTTT

{Crypto Watch: FIO Protocol} For Human Readable Addresses and Building a User Friendly Crypto ...

from #Bitcoinmovement https://ift.tt/3fQL5ox

via IFTTT

Explainer: So you just bought cryptocurrency; how do you store your holdings safely?

from #Bitcoinmovement https://ift.tt/2VmN1vy

via IFTTT

BTIG says cryptocurrency 'comes of age,' puts $50000 target on bitcoin for 2021

from #Bitcoinmovement https://ift.tt/2JsZBXs

via IFTTT

Cryptocurrencies Price Prediction: Bitcoin, Ethereum & Ripple – American Wrap 30 November

from #Bitcoinmovement https://ift.tt/3moUVjX

via IFTTT

Extradition Of Co-Founder Of Global Cryptocurrency Ponzi Scheme, Gutemberg Dos Santos

from #Bitcoinmovement https://ift.tt/39sCt67

via IFTTT

3 Stocks to Scoop Up When Bitcoin Dips

from #Bitcoinmovement https://ift.tt/37qvFn5

via IFTTT

Bitcoin hits new all-time high after rollercoaster week which saw its price fall 12.5% days ago... will ...

from #Bitcoinmovement https://ift.tt/3mqArHv

via IFTTT

Bitcoin hits an all-time high of just under $20000

from #Bitcoinmovement https://ift.tt/3mptjer

via IFTTT

Bitcoin hits all-time record as 2020 rally power on

from #Bitcoinmovement https://ift.tt/3fWIrgP

via IFTTT

Bitcoin futures soar above $20000 as cryptocurrency stages turnaround

from #Bitcoinmovement https://ift.tt/3loHC1z

via IFTTT

Bitcoin Hits New Record, This Time With Less Talk of a Bubble

from #Bitcoinmovement https://ift.tt/2JmHdzG

via IFTTT

Evolving Ethereum: What The Second-Largest Cryptocurrency's 2.0 Upgrade Means For Investors

from #Bitcoinmovement https://ift.tt/3qdvMLf

via IFTTT

Bitcoin reached the new ATH after 1079 days and 84% correction

Submitted November 30, 2020 at 02:56PM by ThatNaimish1 https://ift.tt/2JmRFqW https://ift.tt/2Z7cX2s

WARNING: Paxful is aggressively KYC and doesn't warn users until AFTER depositing bitcoin their funds will be locked until verification is completed

Just posting to warn everyone about paxful. I literally found it on a list of KYC friendly exchanges and sadly that couldn't be more far from the truth

AFTER buying bitcoin through paxful, your funds will be locked until KYC is completed. There is no warning of this beforehand. If you are unable to complete the KYC verification your funds will be permanently locked in paxful. You cannot even trade them back to your original form of payment

The KYC is some of the most aggressive I have ever seen, involving submitting photos of government documents as well as a live 'video selfie' of your face for facial recognition purposes

I'm sure paxful makes quite a killing here, with crypto users that tend to value anonymity choosing to take a loss rather than have a three dimensional profile of their face in some for profit database

Do not use paxful. Do not support this business. This is literally the scummiest practice I have encountered since I began using bitcoin in 2013

Edit: Just because I know someone is going to ask, KYC = know your customer, which is a US government initiative for corporations to know who their customers are for tax/criminal investigative/surveillance purposes

Submitted November 30, 2020 at 04:43PM by fr33dom35 https://ift.tt/3oarZfP https://ift.tt/2Z7cX2s

U.S. Intel Official: We "Cannot Allow China to Dominate" Digital Currencies

Submitted November 30, 2020 at 01:27PM by JokeOlantern https://ift.tt/3loSfkI https://ift.tt/2Z7cX2s

Daily Discussion - December 1, 2020 (GMT+0)

Welcome to the Daily Discussion. Please read the disclaimer, guidelines, and rules before participating.

Disclaimer:

Though karma rules still apply, moderation is less stringent on this thread than on the rest of the sub. Therefore, consider all information posted here with several liberal heaps of salt, and always cross check any information you may read on this thread with known sources. Any trade information posted in this open thread may be highly misleading, and could be an attempt to manipulate new readers by known "pump and dump (PnD) groups" for their own profit. BEWARE of such practices and exercise utmost caution before acting on any trade tip mentioned here.

Rules:

- All sub rules apply in this thread. The prior exemption for karma and age requirements is no longer in effect.

- Discussion topics must be related to cryptocurrency.

- Comments will be sorted by newest first.

To see prior Skeptics Discussions, click here.

Submitted November 30, 2020 at 06:12PM by AutoModerator https://ift.tt/3mrVA3X https://ift.tt/2Z7cX2s

Monthly Skeptics Discussion - December 2020

Welcome to the Monthly Skeptics Discussion thread. The goal of this thread is to promote critical discussion by challenging popular or conventional beliefs.

This thread is scheduled to be reposted on the 1st of every month. Due to the 2 post sticky limit, this thread will not be permanently stickied like the Daily Discussion thread. It will often be taken down to make room for important announcements or news.

Rules:

- All sub rules apply here.

- Discussion topics must be on topic, i.e. only related to skeptical or critical discussion about cryptocurrency. Markets or financial advice discussion, will most likely be removed and is better suited for the daily thread.

- Promotional top-level comments will be removed. For example, giving the current composition of your portfolio or stating you sold X coin for Y coin(shilling), will promptly be removed.

- Karma and age requirements are in full effect and may be increased if necessary.

Guidelines:

- Share any uncertainties, shortcomings, concerns, etc you have about crypto related projects.

- Refer topics such as price, gossip, events, etc to the Daily Discussion.

- Please report top-level promotional comments and/or shilling.

Resources and Tools:

- Read through the CryptoWikis Library for material to discuss and consider contributing to it if you're interested. r/CryptoWikis is the home subreddit for the CryptoWikis project. Its goal is to give an equal voice to supporting and opposing opinions on all crypto related projects. You can also try reading through the Critical Discussion search listing.

- Consider changing your comment sorting around to find more critical discussion. Sorting by controversial might be a good choice.

-

Click the RES subscribe button below if you would like to be notified when comments are posted.

To see prior Daily Discussions, click here.

-

Thank you in advance for your participation.

Submitted November 30, 2020 at 06:12PM by AutoModerator https://ift.tt/2KP8I5b https://ift.tt/2Z7cX2s

Soon enough

Submitted November 30, 2020 at 03:26PM by jiar300 https://ift.tt/2HT6jFA https://ift.tt/2Z7cX2s

ECB Chief Christine Lagarde Downplays Bitcoin’s Risks to Financial Stability, Troubled by Stablecoins

ECB President Christine Lagarde downplays any risks bitcoin and other cryptocurrencies could pose to financial stability and monetary sovereignty. In contrast, she sees stablecoins, such as Facebook-backed libra, as posing “serious risks.”

Christine Lagarde, Bitcoin, and Facebook’s Libra

The president of the European Central Bank (ECB), Christine Lagarde, shared her view on the future of money in an article published Monday in L’ena hors les murs magazine. She specifically discussed “bitcoin or other crypto-assets that have been trying to gain a foothold in the digital payments space and to anchor trust in their technology.”

Lagarde began by stating that innovations like blockchain technology “bring both new opportunities and new risks.” She noted that peer-to-peer (P2P) transactions have “no need for a trusted third-party intermediary,” asserting that the trust “is replaced by cryptographic proofs and the security and integrity of records is ensured by DLT, which avoids the ‘double-spending’ problem.” The ECB chief elaborated:

The main risk lies in relying purely on technology and the flawed concept of there being no identifiable issuer or claim. This also means that users cannot rely on crypto-assets maintaining a stable value: they are highly volatile, illiquid and speculative, and so do not fulfil all the functions of money.

Lagarde proceeded to point out that unlike bitcoin, stablecoins “pose serious risks,” even though they “could drive additional innovation in payments and be well integrated into social media, trade and other platforms.” She explained that stablecoins “try to solve crypto-assets’ problem of a lack of stability and trust by pegging their assets to stable and trusted fiat money issued by States.”

In addition, the issuers of “global” stablecoins, “aim to introduce their own payment schemes and clearing and settlement arrangements.” Global stablecoins are stablecoins that are likely to achieve mass adoption from inception, such as Facebook-backed libra.

The ECB chief warned that if these global stablecoins are widely adopted, “they could threaten financial stability and monetary sovereignty.” For instance, she explained: “if the issuer cannot guarantee a fixed value or if they are perceived as being incapable of absorbing losses, a run could occur. Additionally, using stablecoins as a store of value could trigger a large shift of bank deposits to stablecoins, which may have an impact on banks’ operations and the transmission of monetary policy.”

Moreover, Lagarde believes that stablecoins backed by global tech firms “could also present risks to competitiveness and technological autonomy in Europe, as they would attempt to leverage their competitive advantage and control of large platforms,” adding:

Their dominant positions may harm competition and consumer choice, and raise concerns over data privacy and the misuse of personal information.

Former Goldman Sachs hedge fund manager Raoul Pal commented on Lagarde’s view. He tweeted: “the fear is real and it’s stablecoins they see as the threat, not bitcoin.”

What do you think about Lagarde’s view on bitcoin and stablecoins? Let us know in the comments section below.

The post ECB Chief Christine Lagarde Downplays Bitcoin’s Risks to Financial Stability, Troubled by Stablecoins appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2HTtakm

via IFTTT

Sunday, November 29, 2020

Why doesn't anybody warn people that Changelly is a scam...

It's a site that allows you to set up and account and put money into it. Once you try to do a withdrawl they ask you to verify yourself. If the verification comes from a country they don't approve of, they hold your funds and there is no recourse. They also don't list the countries which you cannot be from before you sign up..

Submitted November 29, 2020 at 03:36PM by Throwawayiea https://ift.tt/3o0Lt6y https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/37pGfuG

via IFTTT

TwitchPlaysCryptoMarket goes live today. Use the chat to vote on what gets bought or sold every 5 minutes. Starting with $2200 USD lets see what the Twitch portfolio will be worth in weeks/months.

Hi everyone. Starting in 15 minutes or so TwitchPlaysCryptoMarket will go live.

Type chat commands (!buy BTC, !buy ETH, !buy XRP, !buy ADA, !sell BTC, !sell ETH, etc) to cast votes. Every 5 minutes the asset with the most votes will have $20 USD bought (minus trading fees)

Check out the stream and schedule here: https://www.twitch.tv/twitchplayscryptomarket/schedule

Look at the stream About tab for more.

Lets see what the community can do. Will it be a nice balanced portfolio or trolls buying a bunch of dead coins (please be kind). Will big gains be sold back into USD at the top? Let's find out.

Please consider following as I need to become a twitch affiliate to earn money and de-risk a little.

Edit: Update #1 Just finished the first 4 hour stream. Thank you to all that attended. Check the link to the schedule for the next stream.

Check out the TwitchPlaysCryptoMarket portfolio here: https://coinstats.app/p/yZQbdo

Submitted November 29, 2020 at 10:44AM by dopeturtle1 https://ift.tt/37ma7rs https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/36ouXHP

via IFTTT

Bitcoin stock to flow model.

Submitted November 29, 2020 at 03:28PM by dan_held https://ift.tt/39oSvxQ https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3fM7EKO

via IFTTT

Five Reasons Ethereum Is Way More Powerful Than Bitcoin

from Google Alert - Bitcoin https://ift.tt/3ljYO8u

Bitcoin carnage, Eth2 milestone, Libra launch, PayPal blunder

from Google Alert - Bitcoin https://ift.tt/2HTCu7Y

Bitcoin returns to $18000 as investors are mixed over what's next for the bull run

from Google Alert - Bitcoin https://ift.tt/2HNAMVs

Many More UK Residents are Buying Bitcoin and Other Cryptos as British Pound falls to Lowest ...

from Google Alert - Bitcoin https://ift.tt/2HSNPVO

Bitcoin To $30000 or Higher? Nothing Says It Has To Drop!

from Google Alert - Bitcoin https://ift.tt/3lknOML

Bitcoin Up Review 2020 – Is it a Scam or Safe to Use?

from Google Alert - Bitcoin https://ift.tt/3mluJ9M

Five Reasons Ethereum Is Way More Powerful Than Bitcoin

from #Bitcoinmovement https://ift.tt/3o3Tl7t

via IFTTT

Ethereum, Bitcoin, Ripples XRP: has China already sold the $ 3 billion in cryptocurrencies?

from #Bitcoinmovement https://ift.tt/3qaUOuz

via IFTTT

Top 5 cryptocurrencies to watch this week: BTC, ETH, ADA, XLM, XEM

from #Bitcoinmovement https://ift.tt/33qf7dA

via IFTTT

Bill Salus: Cryptocurrencies and the Mark of the Beast

from #Bitcoinmovement https://ift.tt/2Jkh44v

via IFTTT

Chinese cryptocurrency and blockchain...

from #Bitcoinmovement https://ift.tt/3o8yT5e

via IFTTT

Sushiswap stops possible exploit in its track & awards bug bounty for it’s discovery.

Submitted November 29, 2020 at 05:30PM by BardCookie https://ift.tt/2VtB6w5 https://ift.tt/2Z7cX2s

Pizza Hut to accept crypto in all its stores in Venezuela

Submitted November 29, 2020 at 02:27PM by robis87 https://ift.tt/37l4U3g https://ift.tt/2Z7cX2s

Where to start if you are looking to invest 1k a month in crypto?

Finally graduated and making enough money to invest. I'd like to set aside roughly $1k a month into crypto. This is money I'm alright with loosing but would love if it have a chance of making money down the road. Where would you start if you were new to crypto for basic knowledge and investing strategies/advice? Thanks for the help!

Submitted November 29, 2020 at 04:05PM by NotADrJustADentist https://ift.tt/3mkKZrn https://ift.tt/2Z7cX2s

Enormous Bitcoin Whale Unloads Crypto Wallet in $386,000,000 Transaction

Submitted November 29, 2020 at 06:19AM by Fhelans https://ift.tt/39rc88r https://ift.tt/2Z7cX2s

U.S. government uses USDC stablecoin to bypass Nicolas Maduro and give funds directly to Venezuelan medical workers (Using Venezuelan funds)

Besides the news I will post.

I know someone close, the process worked like this,

If you are a medical worked and wanted to receive the funds you had to do the following:

- Register in a webpage (As most of the medical workers work in public places administred by Maduro, Maduro's goverment tried several times with phishing, intercept the register to have the database and know the workers that registered to press them). Around 65k workers registered.

- They cross check the data, to make sure everything was legit.

- Wait.

- You would get an email so you register at www.airtm.com (just after that website was blocked by Maduro, you had to use a VPN).

- Wait.

- Weeks later you would get an email, with the confirmation of the first part of the funds. It is 100 USD monthly for three months to any medical worker (medic, nurses and so on). To put things in context, one medic that fights COVID with maybe 10 years of exprience has a monthly wage of MAYBE 50 USD.

- You got the funds in AIRUSD (AirTM stable coin, 1 AIRUSD = 1 USD). After that you can do whatever you can. Keep them there, buy cryptos, cash out (sadly, considering the situation, ALMOST all of them cashed out to Bs. to spend in the supermarket). You can do all of that in AirTM.

All of this against Maduro will, but he wasn't able of blocking it.

Remember, this is a goverment that is against anyone that want to help.

I'm a Venezuelan living here, crypto entusiast, you can AMA.

Sources:

https://www.coindesk.com/circle-usdc-venezuela-airtm

https://www.nytimes.com/2020/11/26/world/asia/venezuela-charity-raid.html

Submitted November 29, 2020 at 07:19AM by WorkingLime https://ift.tt/2VlwJ5P https://ift.tt/2Z7cX2s

One coin's commenters are not quite like all the other coins' commenters

Submitted November 29, 2020 at 12:34PM by jwinterm https://ift.tt/3o7Cyk0 https://ift.tt/2Z7cX2s

Why doesn't anybody warn people that Changelly is a scam...

It's a site that allows you to set up and account and put money into it. Once you try to do a withdrawl they ask you to verify yourself. If the verification comes from a country they don't approve of, they hold your funds and there is no recourse. They also don't list the countries which you cannot be from before you sign up..

Submitted November 29, 2020 at 03:36PM by Throwawayiea https://ift.tt/3o0Lt6y https://ift.tt/2Z7cX2s

TwitchPlaysCryptoMarket goes live today. Use the chat to vote on what gets bought or sold every 5 minutes. Starting with $2200 USD lets see what the Twitch portfolio will be worth in weeks/months.

Hi everyone. Starting in 15 minutes or so TwitchPlaysCryptoMarket will go live.

Type chat commands (!buy BTC, !buy ETH, !buy XRP, !buy ADA, !sell BTC, !sell ETH, etc) to cast votes. Every 5 minutes the asset with the most votes will have $20 USD bought (minus trading fees)

Check out the stream and schedule here: https://www.twitch.tv/twitchplayscryptomarket/schedule

Look at the stream About tab for more.

Lets see what the community can do. Will it be a nice balanced portfolio or trolls buying a bunch of dead coins (please be kind). Will big gains be sold back into USD at the top? Let's find out.

Please consider following as I need to become a twitch affiliate to earn money and de-risk a little.

Edit: Update #1 Just finished the first 4 hour stream. Thank you to all that attended. Check the link to the schedule for the next stream.

Check out the TwitchPlaysCryptoMarket portfolio here: https://coinstats.app/p/yZQbdo

Submitted November 29, 2020 at 10:44AM by dopeturtle1 https://ift.tt/37ma7rs https://ift.tt/2Z7cX2s

Bitcoin stock to flow model.

Submitted November 29, 2020 at 03:28PM by dan_held https://ift.tt/39oSvxQ https://ift.tt/2Z7cX2s

Saturday, November 28, 2020

I. Petrova | Revista San Gregorio

from #Bitcoinmovement https://ift.tt/39pV4A0

via IFTTT

It's sad, but it's true 😅

Submitted November 28, 2020 at 06:17PM by TR5_ https://ift.tt/37eWYAF https://ift.tt/2Z7cX2s

Here's to 13 years on Reddit🍻

Submitted November 28, 2020 at 04:09PM by 0rbytal https://ift.tt/2HQN6EC https://ift.tt/2Z7cX2s

CME Group Outpaces Competition Becoming the World's Largest Bitcoin Futures Market

from Google Alert - Bitcoin https://ift.tt/2VavVRk

Major BTC Investors Are Not Bearish On Bitcoin And Here's Why

from Google Alert - Bitcoin https://ift.tt/2JsGFaY

Ukrainian government sponsors educational web show about cryptocurrencies

from #Bitcoinmovement https://ift.tt/3mkHVM1

via IFTTT

Ripple (XRP) shoots 20% as cryptocurrencies recover from falling

from #Bitcoinmovement https://ift.tt/3o2uYqE

via IFTTT

Bitcoin carnage, Eth2 milestone, Libra launch, PayPal blunder: Hodler's Digest, Nov. 21–27

from #Bitcoinmovement https://ift.tt/3q3Pjh4

via IFTTT

All Pizza Hut Locations Accept Cryptocurrencies in Venezuela

from #Bitcoinmovement https://ift.tt/33qyIdT

via IFTTT

Libra, the cryptocurrency that Facebook would launch at the beginning of the following year

from #Bitcoinmovement https://ift.tt/37eEtfL

via IFTTT

Daily Discussion - November 29, 2020 (GMT+0)

Welcome to the Daily Discussion. Please read the disclaimer, guidelines, and rules before participating.

Disclaimer:

Though karma rules still apply, moderation is less stringent on this thread than on the rest of the sub. Therefore, consider all information posted here with several liberal heaps of salt, and always cross check any information you may read on this thread with known sources. Any trade information posted in this open thread may be highly misleading, and could be an attempt to manipulate new readers by known "pump and dump (PnD) groups" for their own profit. BEWARE of such practices and exercise utmost caution before acting on any trade tip mentioned here.

Rules:

- All sub rules apply in this thread. The prior exemption for karma and age requirements is no longer in effect.

- Discussion topics must be related to cryptocurrency.

- Comments will be sorted by newest first.

To see prior Skeptics Discussions, click here.

Submitted November 28, 2020 at 06:11PM by AutoModerator https://ift.tt/39ofV6t https://ift.tt/2Z7cX2s

CME Group Outpaces Competition Becoming the World’s Largest Bitcoin Futures Market

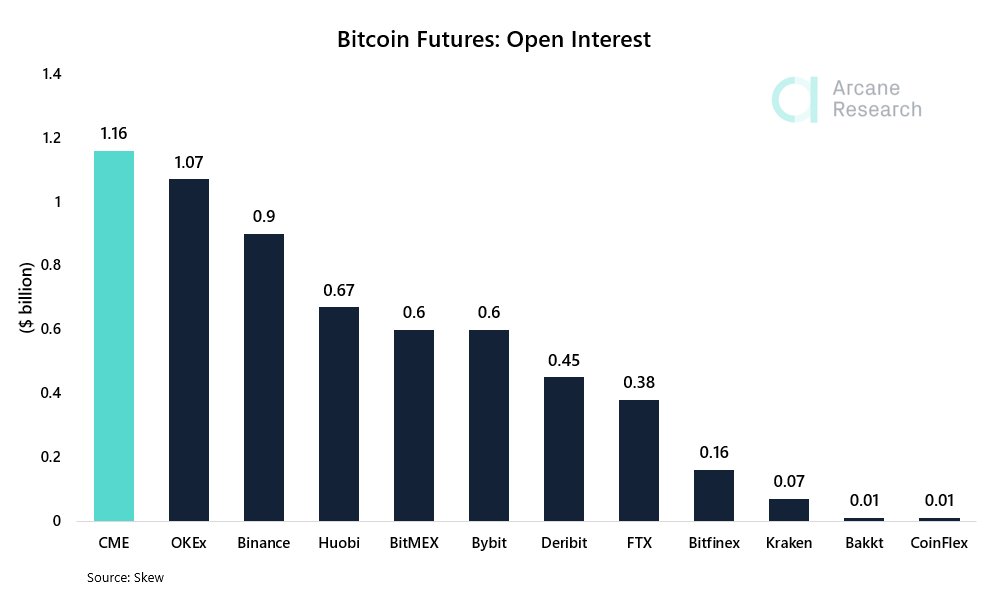

Financial derivatives products for bitcoin have grown massively during the last few months. On Friday evening (EST), Arcane Research explained that the Chicago Mercantile Exchange has surpassed Okex as the largest bitcoin futures provider. The regulated derivatives market at CME has doubled month after month as incoming interest has created more demand for CME’s bitcoin futures.

- The Chicago Mercantile Exchange (CME Group) is the world’s largest financial derivatives exchange that trades in various asset classes. The exchange first launched its bitcoin futures products back in December 2017, and since then the demand for crypto derivatives has skyrocketed.

- On October 14, 2020, the investment manager Wilshire Phoenix published a study which says that “CME Bitcoin Futures contribute more to price discovery than its related spot markets.”

- “CME Bitcoin Futures have grown to become significant, this is not only demonstrated through trading volume and open interest, but also by influence on spot price formation,” the investment manager’s research called “Efficient Price Discovery in the Bitcoin Markets” said.

- On October 24, 2020, news.Bitcoin.com reported on how CME Group became the second-largest derivatives market for bitcoin futures in terms of open interest. Two key events helped push CME’s futures above the competitors; the crypto support announcement from Paypal, and the legal troubles surrounding the derivatives exchange Bitmex.

- This week, CME Group has surpassed Okex and is the largest bitcoin futures provider at the time of publication. The exchange has captured over $1.16 billion in open interest toward its bitcoin futures market product. This is just a hair above the exchange Okex, which commands $1.07 billion in bitcoin futures open interest.

- The research and analysis firm Arcane Research tweeted about the latest CME Group milestone after obtaining data from Skew.com. “According to data from Skew.com, CME is now the largest futures market for bitcoin. Institutional investors are here,” Arcane tweeted on November 27.

- Other bitcoin derivatives exchanges that are also seeing notable open interest spikes include Binance, Huobi, and Bybit. In fact, according to Arcane Research’s recent tweet, Bybit and Bitmex share the same amount of open interest.

- The bitcoin derivatives exchange Bakkt, which deals in physically-settled bitcoin futures is barely a blip on the radar compared to competitors.

What do you think about CME outpacing the competitors like Okex when it comes to bitcoin futures open interest? Let us know what you think about this subject in the comments section below.

The post CME Group Outpaces Competition Becoming the World’s Largest Bitcoin Futures Market appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/3q9zoOd

via IFTTT

BITCOIN Is it repeating the May10 pull back or can decline more?

from Google Alert - Bitcoin https://ift.tt/37eOeug

Bitcoin price – Bitcoin Analysts Clarify Why price Is Rallying Once more

from Google Alert - Bitcoin https://ift.tt/36egz4H

Nigeria emerging as a true Bitcoin nation

from Google Alert - Bitcoin https://ift.tt/3o3Wowd

Bitcoin and Cryptocurrency Worth $4 Billion Seized From Top Crypto Ponzi Group

from Google Alert - Bitcoin https://ift.tt/36hjSbh

Bitcoin, Facing Two Upcoming Scenarios, One More Likely One!

from Google Alert - Bitcoin https://ift.tt/2Vb1lan

Ukrainian government sponsors educational web show about cryptocurrencies

from #Bitcoinmovement https://ift.tt/2VdQRHc

via IFTTT

Facebook cryptocurrency Libra to launch as early as January

from #Bitcoinmovement https://ift.tt/3qdIsSy

via IFTTT

Bitcoin (BTC) Outperformed Every Mainstream Asset Class in 2020, as Family Offices Look to ...

from #Bitcoinmovement https://ift.tt/3qkFknU

via IFTTT

Bitcoin and Crypto Worth $4 Billion Seized From PlusToken Ponzi Group

from #Bitcoinmovement https://ift.tt/3lh8pgd

via IFTTT

“Facebook” reveals the details of the “Libra” cryptocurrency

from #Bitcoinmovement https://ift.tt/37ezhZj

via IFTTT

BTC $100K, ETH $10k lets go!

Submitted November 28, 2020 at 12:06PM by princehints https://ift.tt/3lpLEa5 https://ift.tt/2Z7cX2s

Friday, November 27, 2020

I did it. I emptied my Coinbase account.

Yeah, the title was a little bait and switch, but I did empty my coinbase account. I finally pulled the trigger and took control of my own keys.

I have always been hesitant to maintain full custody of my bitcoin since I wasn't 100% sure I could reliably and responsibly control it. My personal coinbase holdings were from my early days and it has been a relatively small amount. Plus I've just been lazy.

However, with everything going on with Coinbase, and rumors that they will be introducing new policies with the US government regarding self-custody, I am pretty worried they will sanction BTC for all US citizens. Yes, I know it's an extreme case, but as soon as things get real and the current elite realize they have holes in their moneybags (inflation, quantitative easing, stimulus, money printing, bailouts, etc...), they will probably take extreme measures to make sure they retain power.

p.s.

If anyone has or knows someone with mass amounts of venture capital, and wants to bring a better mousetrap to the market, I have a working concept for a hardware wallet that is better than any of the current offerings. I have the manufacturing set up. Just need the money to place the order. I also have experience in manufacturing crypto hardware and software, created the first plug-and-play bitcoin miner, and founded Hands Free Bitcoin. And before anyone starts trolling, yes, my business accounts have always had excessive custodial measures taken to ensure security. My personal coinbase holdings were from my early days and I just haven't taken time to pay much attention to them until now.

Submitted November 27, 2020 at 03:19PM by Adamsimecka https://ift.tt/2JoVk75 https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/37fJEvN

via IFTTT

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3mgDmT4

via IFTTT

US Director of National Intelligence Urges SEC to Support Bitcoin and Crypto Companies: Report

Submitted November 27, 2020 at 01:52PM by da_dreamerr https://ift.tt/3lbl6Jj https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/2Jgu5vA

via IFTTT

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3mhYc4l

via IFTTT

Grayscale Bitcoin Cash Trust: Pure Lunacy

from Google Alert - Bitcoin https://ift.tt/3o2lED9

Record-setting bitcoin faces test after volatile week

from Google Alert - Bitcoin https://ift.tt/2Vc0uWU

Bitcoin for the Win: MintGox Pays Online Gamers in Crypto

from Google Alert - Bitcoin https://ift.tt/379Ili0

Price analysis 11/27: BTC, ETH, XRP, BCH, LINK, LTC, ADA, DOT, XLM, BNB

from Google Alert - Bitcoin https://ift.tt/3q9EDNW

Bitcoin's Price Plunged and Explanations Abound

from Google Alert - Bitcoin https://ift.tt/2HKS8Cz

Newly Launched Bitcoin Latinum Set to Become World's Largest Insured Digital Asset

from Google Alert - Bitcoin https://ift.tt/3mfll7J

Here are key reasons bitcoin prices are tumbling, and the bullish factors that may buoy them

from Google Alert - Bitcoin https://ift.tt/2JdKwJi

Going long on Bitcoin, how risky is it?

from Google Alert - Bitcoin https://ift.tt/33nL2LS

How it's ended 😎

Submitted November 27, 2020 at 07:46PM by devboricha https://ift.tt/2Vcqx0c https://ift.tt/2Z7cX2s

Bitcoin be like

Submitted November 27, 2020 at 07:32PM by dannydorrito https://ift.tt/36epQKb https://ift.tt/2Z7cX2s

Researcher Publishes Never Before Seen Emails Between Satoshi Nakamoto and Hal Finney

Just recently three previously unpublished emails from Bitcoin’s inventor, Satoshi Nakamoto, have been made public. The emails reveal the correspondence between Satoshi and the early Bitcoin developer Hal Finney. The communications between Nakamoto and Finney stem from November 2008 and January 2009, the very month Bitcoin was launched.

On November 27, three emails that have never been seen before were made public in an editorial written by Michael Kaplikov, a professor at Pace University. According to Kaplikov, the emails derived from the New York Times contributor Nathaniel Popper. The NYT journalist also wrote the book “Digital Gold” and Hal Finney’s wife Fran Finney gave Popper the emails at this time. Kaplikov published the emails alongside his editorial after confirming that the emails were indeed legitimate, and stemmed from the now-deceased Hal Finney’s old computer.

The first email is dated November 19, 2008, which was nineteen days after Bitcoin’s mysterious creator published the white paper. Kaplikov, who has been studying the Bitcoin origin story, said that before the email, Nakamoto shared an early version of the Bitcoin codebase with a few people including Hal Finney. The early release origin story is well known, as Ray Dillinger and James A. Donald also received pre-release copies. In the email, Finney asked Satoshi about the number of nodes and scaling the Bitcoin network.

“Some of the discussion and concern over performance may relate to the eventual size of the P2P network,” Finney wrote to Nakamoto. “How large do you envision it becoming? Tens of nodes. Thousands? Millions? And for clients, do you think this could scale to be usable for close to 100% of the world’s financial transactions? Or would you see it as mostly being used for some ‘core’ subset of transactions that have special requirements, with other transactions using a different payment system that perhaps is based on Bitcoin?”

The researcher from Pace University also highlighted that soon after this particular email, Bitcoin’s creator allowed Finney commit access to the Sourceforge repository. Then another email dated January 8, 2009, shortly after the network was launched, Satoshi wrote to Hal. “Thought you’d like to know, the Bitcoin v0.1 release with EXE and full sourcecode is up on Sourceforge,” Nakamoto wrote. The creator also detailed that release notes and screenshots were also uploaded to the web portal bitcoin.org. The very next day, Finney replied to Nakamoto’s release email.

“Hi, Satoshi, thanks very much for that information,” Finney said on January 9. “I should have a chance to look at that this weekend. I am looking forward to learning more about the code.”

Running bitcoin

— halfin (@halfin) January 11, 2009

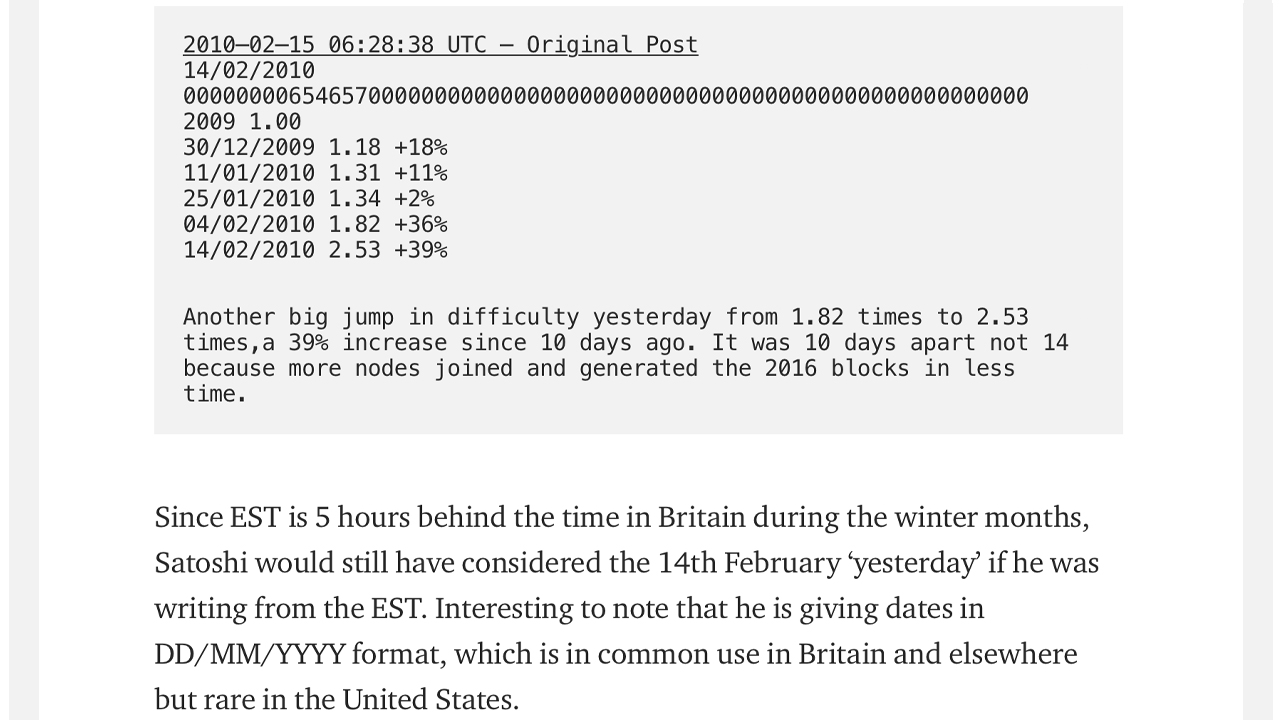

The very next day, Hal Finney took to Twitter and told his followers he was “running bitcoin.” It seems Finney did get a chance to look at the code after his recent correspondence with Nakamoto. In addition to the three unpublished emails, Kaplikov also discussed the email correspondence between Finney and Nakamoto that was given to the Wall Street Journal back in 2014.

The reason for this is because Kaplikov discusses discrepancies with the email’s timestamps. Kaplikov stresses that the January 2009 emails appear to be roughly eight hours ahead of Greenwich Mean Time (GMT). Just recently, new research from The Chain Bulletin contributor Doncho Karaivanov tried to pinpoint Satoshi’s home location by leveraging all his activity and scatter charts of all the timestamps.

Karaivanov’s study assumes that Satoshi Nakamoto lived in London (GMT) when he/she or they created the Bitcoin project. However, studies from the past show that Nakamoto could have also resided in California on the west coast and some have asserted he lived on the eastern side of the United States. Moreover, it is also assumed in a few of the studies that Satoshi Nakamoto pulled a lot of ‘all-nighters’ and crammed his work before he left the project.

Finney passed away on August 28, 2014, after suffering from complications from Amyotrophic lateral sclerosis (ALS). Bitcoiners and crypto proponents everywhere think of Finney in the highest regard, as he once said that the computer could help liberate people.

“It seemed so obvious to me,” Finney explained before his death. “Here we are faced with the problems of loss of privacy, creeping computerization, massive databases, more centralization – and [David] Chaum offers a completely different direction to go in, one which puts power into the hands of individuals rather than governments and corporations. The computer can be used as a tool to liberate and protect people, rather than to control them.”

The recently published emails are interesting and give some new insight into the early relationship between Nakamoto and Finney. The emails and Finney’s post on Twitter on January 10, clearly show he was very excited about this project and specifically made time available to look at Bitcoin right away. The email timestamps simply add more to the Satoshi Nakamoto identity mystery, and the uncertainty of the inventor’s whereabouts during the cryptocurrency’s creation period.

What do you think about the email correspondence between Nakamoto and Finney? Let us know what you think about this subject in the comments section below.

The post Researcher Publishes Never Before Seen Emails Between Satoshi Nakamoto and Hal Finney appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/33oKR2P

via IFTTT

This subreddit is Diego Maradona - RIP in peace to a legend

Submitted November 27, 2020 at 06:00PM by jwinterm https://ift.tt/3qauqRg https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/2VcLW9A

via IFTTT

Negative Bitcoin headlines affect speculators, not HODLers says Morgan Creek CEO

Submitted November 27, 2020 at 04:35PM by robis87 https://ift.tt/36bX8cz https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3o0EOJG

via IFTTT

Daily Discussion - November 28, 2020 (GMT+0)

Welcome to the Daily Discussion. Please read the disclaimer, guidelines, and rules before participating.

Disclaimer:

Though karma rules still apply, moderation is less stringent on this thread than on the rest of the sub. Therefore, consider all information posted here with several liberal heaps of salt, and always cross check any information you may read on this thread with known sources. Any trade information posted in this open thread may be highly misleading, and could be an attempt to manipulate new readers by known "pump and dump (PnD) groups" for their own profit. BEWARE of such practices and exercise utmost caution before acting on any trade tip mentioned here.

Rules:

- All sub rules apply in this thread. The prior exemption for karma and age requirements is no longer in effect.

- Discussion topics must be related to cryptocurrency.

- Comments will be sorted by newest first.

To see prior Skeptics Discussions, click here.

Submitted November 27, 2020 at 06:10PM by AutoModerator https://ift.tt/3q1UMoN https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3fUijDz

via IFTTT

I did it. I emptied my Coinbase account.

Yeah, the title was a little bait and switch, but I did empty my coinbase account. I finally pulled the trigger and took control of my own keys.

I have always been hesitant to maintain full custody of my bitcoin since I wasn't 100% sure I could reliably and responsibly control it. My personal coinbase holdings were from my early days and it has been a relatively small amount. Plus I've just been lazy.

However, with everything going on with Coinbase, and rumors that they will be introducing new policies with the US government regarding self-custody, I am pretty worried they will sanction BTC for all US citizens. Yes, I know it's an extreme case, but as soon as things get real and the current elite realize they have holes in their moneybags (inflation, quantitative easing, stimulus, money printing, bailouts, etc...), they will probably take extreme measures to make sure they retain power.

p.s.

If anyone has or knows someone with mass amounts of venture capital, and wants to bring a better mousetrap to the market, I have a working concept for a hardware wallet that is better than any of the current offerings. I have the manufacturing set up. Just need the money to place the order. I also have experience in manufacturing crypto hardware and software, created the first plug-and-play bitcoin miner, and founded Hands Free Bitcoin. And before anyone starts trolling, yes, my business accounts have always had excessive custodial measures taken to ensure security. My personal coinbase holdings were from my early days and I just haven't taken time to pay much attention to them until now.

Submitted November 27, 2020 at 03:19PM by Adamsimecka https://ift.tt/2JoVk75 https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/37fJEvN

via IFTTT

US Director of National Intelligence Urges SEC to Support Bitcoin and Crypto Companies: Report

Submitted November 27, 2020 at 01:52PM by da_dreamerr https://ift.tt/3lbl6Jj https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/2Jgu5vA

via IFTTT

This subreddit is Diego Maradona - RIP in peace to a legend

Submitted November 27, 2020 at 06:00PM by jwinterm https://ift.tt/3qauqRg https://ift.tt/2Z7cX2s

Negative Bitcoin headlines affect speculators, not HODLers says Morgan Creek CEO

Submitted November 27, 2020 at 04:35PM by robis87 https://ift.tt/36bX8cz https://ift.tt/2Z7cX2s

Daily Discussion - November 28, 2020 (GMT+0)

Welcome to the Daily Discussion. Please read the disclaimer, guidelines, and rules before participating.

Disclaimer:

Though karma rules still apply, moderation is less stringent on this thread than on the rest of the sub. Therefore, consider all information posted here with several liberal heaps of salt, and always cross check any information you may read on this thread with known sources. Any trade information posted in this open thread may be highly misleading, and could be an attempt to manipulate new readers by known "pump and dump (PnD) groups" for their own profit. BEWARE of such practices and exercise utmost caution before acting on any trade tip mentioned here.

Rules:

- All sub rules apply in this thread. The prior exemption for karma and age requirements is no longer in effect.

- Discussion topics must be related to cryptocurrency.

- Comments will be sorted by newest first.

To see prior Skeptics Discussions, click here.

Submitted November 27, 2020 at 06:10PM by AutoModerator https://ift.tt/3q1UMoN https://ift.tt/2Z7cX2s

I did it. I emptied my Coinbase account.

Yeah, the title was a little bait and switch, but I did empty my coinbase account. I finally pulled the trigger and took control of my own keys.

I have always been hesitant to maintain full custody of my bitcoin since I wasn't 100% sure I could reliably and responsibly control it. My personal coinbase holdings were from my early days and it has been a relatively small amount. Plus I've just been lazy.

However, with everything going on with Coinbase, and rumors that they will be introducing new policies with the US government regarding self-custody, I am pretty worried they will sanction BTC for all US citizens. Yes, I know it's an extreme case, but as soon as things get real and the current elite realize they have holes in their moneybags (inflation, quantitative easing, stimulus, money printing, bailouts, etc...), they will probably take extreme measures to make sure they retain power.

p.s.

If anyone has or knows someone with mass amounts of venture capital, and wants to bring a better mousetrap to the market, I have a working concept for a hardware wallet that is better than any of the current offerings. I have the manufacturing set up. Just need the money to place the order. I also have experience in manufacturing crypto hardware and software, created the first plug-and-play bitcoin miner, and founded Hands Free Bitcoin. And before anyone starts trolling, yes, my business accounts have always had excessive custodial measures taken to ensure security. My personal coinbase holdings were from my early days and I just haven't taken time to pay much attention to them until now.

Submitted November 27, 2020 at 03:19PM by Adamsimecka https://ift.tt/2JoVk75 https://ift.tt/2Z7cX2s

US Director of National Intelligence Urges SEC to Support Bitcoin and Crypto Companies: Report

Submitted November 27, 2020 at 01:52PM by da_dreamerr https://ift.tt/3lbl6Jj https://ift.tt/2Z7cX2s

Thursday, November 26, 2020

Bitcoin at $100000 in 2021? Outrageous To Some, a No-Brainer for Backers

from Google Alert - Bitcoin https://ift.tt/37eF7tp

Can you withdraw Bitcoin from Coinbase?

from Google Alert - Bitcoin https://ift.tt/3q71SIH

Thankful

I'm 60 and have been a longterm bitcoin investor ever since I stumbled upon this community.

i want to thank all those who have given me the motivation and the information that a person my age (53 then) needed to get started and get somewhat knowledgeable with this new technology money thing.

I was, 7 years ago, in crippling debt and praying The Lord to find a way to send my children to college one day. After discovering this community and reading up on all the posts I scrapped together all I could, sold my car, my wife's car (with her consent of course) and invested all of it into bitcoin.

The stress on my shoulders was unreal, I don't know what I would have done had this failed. But one day I saw the light at the end of the tunnel. I couldn't believe it. The next few years of my life were simply beyond anything I could have imagined. I paid off my debts, bought a house for me and my family, and sent 2 of my kids to college. (Last one graduates this year from high school)

Yesterday my house burned down. My stuff is pretty much a loss and ill have to find a new place to live, but my kids are ok, my wife is ok and all of the pets are ok. Pictured is my 13 year old cat after being rescued by the Fire Department.

Sadly I kept my crypto offline on a laptop that was in the room the fire started in. I'm told it's gone.

After losing my job this year due to lockdowns and everything that happened yesterday I'm really not sure what I'm supposed to do or what the future holds for me and my family. I got lucky in the past and have faith I'll get lucky again. But all I care about right now is letting this community know how thankful I am for everything they have done to make my past 7 years the happiest I could have ever asked for. Thank you for talking to me and explaining to an out of touch old fart how this whole thing worked. I wish all of you a happy crypto journey and life ahead!

Rob.

( I would have liked to thank a few users personally so I apologize for the throwaway account but people I know follow me on my main one)

Submitted November 26, 2020 at 06:18PM by RelevantReplyAgent https://ift.tt/3nXV6my https://ift.tt/2Z7cX2s

Daily Discussion - November 27, 2020 (GMT+0)

Welcome to the Daily Discussion. Please read the disclaimer, guidelines, and rules before participating.

Disclaimer:

Though karma rules still apply, moderation is less stringent on this thread than on the rest of the sub. Therefore, consider all information posted here with several liberal heaps of salt, and always cross check any information you may read on this thread with known sources. Any trade information posted in this open thread may be highly misleading, and could be an attempt to manipulate new readers by known "pump and dump (PnD) groups" for their own profit. BEWARE of such practices and exercise utmost caution before acting on any trade tip mentioned here.

Rules:

- All sub rules apply in this thread. The prior exemption for karma and age requirements is no longer in effect.

- Discussion topics must be related to cryptocurrency.

- Comments will be sorted by newest first.

To see prior Skeptics Discussions, click here.

Submitted November 26, 2020 at 06:12PM by AutoModerator https://ift.tt/37i9q2K https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3fCpjER

via IFTTT

Lot of us bought at 1k in 2014 and 20k in 2017

And we saw it correct 80%. It felt like chewing glass while being constantly punched in the face.

So guys who just got in, don't bitch about a little correction. You bought Bitcoin, not a bank fixed deposit.

Submitted November 26, 2020 at 02:15PM by thecryptomask https://ift.tt/2V7tmiU https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/2JlI9nm

via IFTTT

Record $7.4B Bitcoin futures open interest shows pros still expect $20K BTC

from Google Alert - Bitcoin https://ift.tt/3676hDp

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/2Jiq2Pe

via IFTTT

Bitcoin Black Friday Is Back On November 27!

from Google Alert - Bitcoin https://ift.tt/3ljbRah

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3fKUJsD

via IFTTT

RBA eyes wave of digital sovereign currencies

from #Bitcoinmovement https://ift.tt/36achve

via IFTTT

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3qcNqPt

via IFTTT

CPPIB and GIC still sceptical on cryptocurrencies

from #Bitcoinmovement https://ift.tt/3leaFoi

via IFTTT

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3maBif7

via IFTTT

Cryptocurrency scheme under investigation in NZ

from #Bitcoinmovement https://ift.tt/3fQ5hXH

via IFTTT

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3fGr83m

via IFTTT

Important Service For Banking Cryptocurrency Exchanges

from #Bitcoinmovement https://ift.tt/33lbhCJ

via IFTTT

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3m6hmKt

via IFTTT

3 Reasons Bitcoin Crashed by $3000 – And Why It's Still Bullish

from #Bitcoinmovement https://ift.tt/2JhDMKl

via IFTTT

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/2V4gvOn

via IFTTT

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.” – F.A. Hayek, 1984

Submitted November 26, 2020 at 04:05PM by riskcapitalist https://ift.tt/2JlhJCA https://ift.tt/2Z7cX2s

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3q1BDTQ

via IFTTT

Daily Discussion - November 27, 2020 (GMT+0)

Welcome to the Daily Discussion. Please read the disclaimer, guidelines, and rules before participating.

Disclaimer:

Though karma rules still apply, moderation is less stringent on this thread than on the rest of the sub. Therefore, consider all information posted here with several liberal heaps of salt, and always cross check any information you may read on this thread with known sources. Any trade information posted in this open thread may be highly misleading, and could be an attempt to manipulate new readers by known "pump and dump (PnD) groups" for their own profit. BEWARE of such practices and exercise utmost caution before acting on any trade tip mentioned here.

Rules:

- All sub rules apply in this thread. The prior exemption for karma and age requirements is no longer in effect.

- Discussion topics must be related to cryptocurrency.

- Comments will be sorted by newest first.

To see prior Skeptics Discussions, click here.

Submitted November 26, 2020 at 06:12PM by AutoModerator https://ift.tt/37i9q2K https://ift.tt/2Z7cX2s

Lot of us bought at 1k in 2014 and 20k in 2017

And we saw it correct 80%. It felt like chewing glass while being constantly punched in the face.

So guys who just got in, don't bitch about a little correction. You bought Bitcoin, not a bank fixed deposit.

Submitted November 26, 2020 at 02:15PM by thecryptomask https://ift.tt/2V7tmiU https://ift.tt/2Z7cX2s

Record $7.4B Bitcoin futures open interest shows pros still expect $20K BTC

from Google Alert - Bitcoin https://ift.tt/3676hDp

Bitcoin Black Friday Is Back On November 27!

from Google Alert - Bitcoin https://ift.tt/3ljbRah

RBA eyes wave of digital sovereign currencies

from #Bitcoinmovement https://ift.tt/36achve

via IFTTT

CPPIB and GIC still sceptical on cryptocurrencies

from #Bitcoinmovement https://ift.tt/3leaFoi

via IFTTT

Cryptocurrency scheme under investigation in NZ

from #Bitcoinmovement https://ift.tt/3fQ5hXH

via IFTTT

Important Service For Banking Cryptocurrency Exchanges

from #Bitcoinmovement https://ift.tt/33lbhCJ

via IFTTT

3 Reasons Bitcoin Crashed by $3000 – And Why It's Still Bullish

from #Bitcoinmovement https://ift.tt/2JhDMKl

via IFTTT

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.” – F.A. Hayek, 1984

Submitted November 26, 2020 at 04:05PM by riskcapitalist https://ift.tt/2JlhJCA https://ift.tt/2Z7cX2s

Wednesday, November 25, 2020

New Research Suggests Satoshi Nakamoto Lived in London Creating Bitcoin

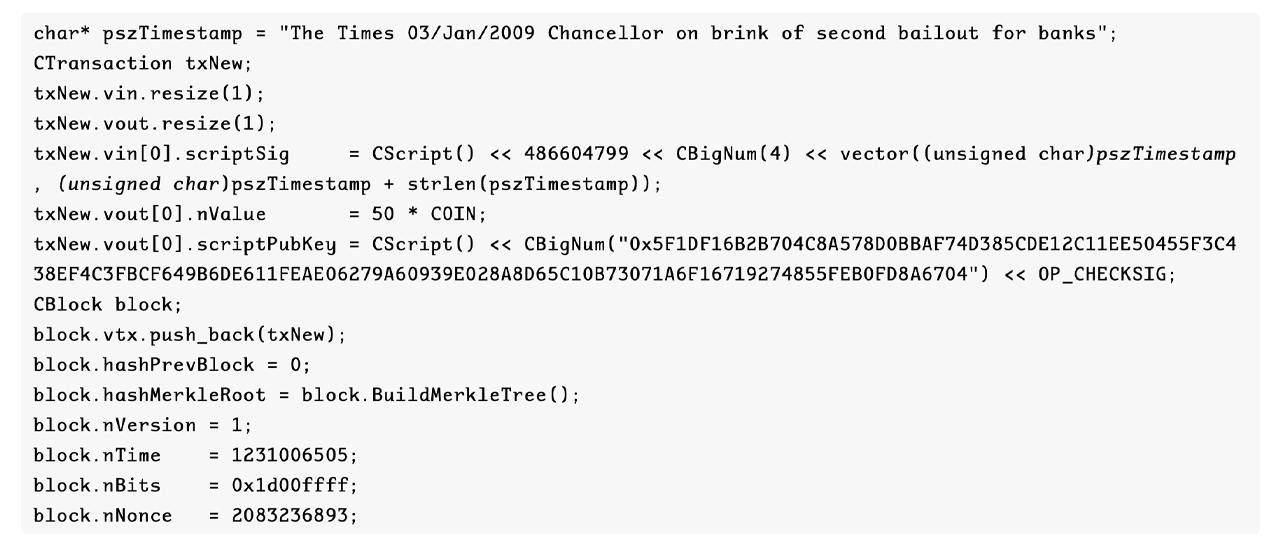

The hunt for the mysterious Bitcoin inventor, Satoshi Nakamoto continues to this day, as new data-driven research has been recently deployed in order to figure out the creator’s location while he/she or they worked on the network. The researchers analyzed Satoshi’s 539 Bitcointalk posts, 34 emails, 169 code commits, metadata from all the versions of bitcoin he worked on, the genesis block data, and archived data from the Wayback Machine.

Report Suggests Satoshi Nakamoto Lived in London While Creating Bitcoin

To this very day, the world is still clueless about the identity of Satoshi Nakamoto, the creator of the first cryptocurrency network Bitcoin. Just recently, research stemming from The Chain Bulletin published an editorial that attempts to hone in on Satoshi Nakamoto’s location during the creation of the world’s first blockchain.

On November 23, 2020, the author Doncho Karaivanov explains researchers combed through “Satoshi’s Bitcointalk posts, Sourceforge commits, and emails, along with other available data.” According to the research, the data points to “the most likely place the anonymous inventor of Bitcoin called home – London.”

Karaivanov says the research is data-driven and relies on timestamps that cover approximately “742 activity instances from 206 days (not consecutive).” The timestamped documentation started on Halloween on October 31, 2008, and statistics end on December 13, 2010, which was the last time the community heard from Satoshi. The researchers compiled scatter charts based on suspected time zones in order to see when Bitcoin’s mysterious inventor was awake and active.

“Common suspect locations are the UK (GMT), US Eastern (EST), US Pacific (PST), Japan (JST), and Australia (AEST),” Karaivanov’s study details. “The last two were easy to debunk, but the first three prospects needed further examination.”

On Sourceforge, a code repository web portal where the Bitcoin code was once stored, Satoshi deployed 169 commits during that period of time. Again the researchers used scatter charts based on specific time zones to analyze Satoshi’s commit activity, which has proof timestamps in UTC.

Similarly, the commit charts just like the Bitcointalk post charts, are consistent and Karaivanov notes that they don’t leave a smoking gun in any of the plausible regions. Then the researchers charted Satoshi’s bulk of email activity which alone did not leave any hard evidence. However, by merging all the data from the Bitcointalk posts, commits, and emails the data starts to deduce that Satoshi’s home location wasn’t in Japan or Australia.

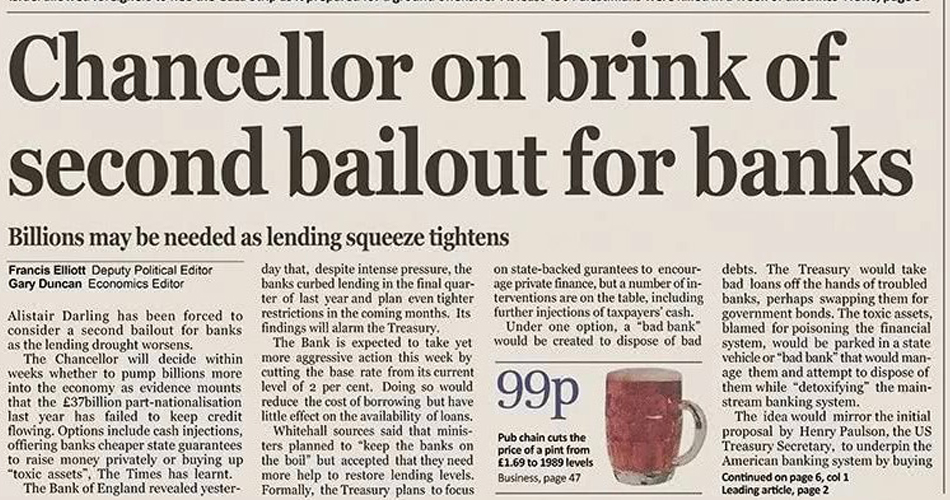

Bitcoin’s Genesis Block: ‘Chancellor on Brink of Second Bailout for Banks’

The biggest clue that points to Satoshi stemming from London resided in the genesis block’s initial message taken from The Times (Times of London) newspaper issue on January 3, 2009.

According to the researchers they deduct that Nakamoto could not have seen the Times of London headline, if the inventor was located in the United States. “This exact issue of The Times did not circulate in the United States,” Karaivanov wrote.

Karaivanov says that it would be “extremely unlikely” that the front page of the U.S. edition was formatted in the same way, as it would be entirely different than the Times of London headline in the UK. Moreover, the newspaper did have an online version of the story, but the headline was written in a completely different way. That specific online article said: “Chancellor Alistair Darling on brink of second bailout for banks.”

The genesis block data tips the scales “heavily in favor of the GMT time zone,” the author insists. “This is without mentioning all the clues that point to Satoshi being British, like his spelling of endings with -ise instead of -ize and -our instead of -or, e.g., analyse, organise, neighbour, colour, etc,” Karaivanov’s study concludes. “Then there’s his use of the word bloody. More specifically, we not only think he is British, but that he also lived in London while working on Bitcoin.”

Karaivanov also concedes by saying that it is impossible to say with “absolute certainty” that London was the precise location. “However, we can say, with reasonable confidence, that he was located in London,” the researcher added.

Satoshi Time Zone Studies from 2011 and 2018

Karaivanov’s research is not the first time Satoshi clues have been uncovered by researching specific time zones in comparison with Nakamoto’s known online activity. In February 2018, another data-driven research study called “The Time Zones of Satoshi Nakamoto,” also attempted to uncover Nakamoto’s location during the creation of Bitcoin as well.

For instance, the report highlights an early draft of the Bitcoin paper and the paper’s online metadata. Alongside this, they looked at the metadata tied to the bitcoin.org/bitcoin.pdf Nakamoto also created. Combining the two timestamp values, indicates the computer Satoshi used to do these things online was set to ‘Mountain Time Zone’ in the United States.

But the 2018 paper about Satoshi’s time zones is a bit more inconclusive, as there are multiple timestamps that show Satoshi could’ve been located in a myriad of regions. For example, the 2018 study also says that Satoshi’s commits indicate his computer leveraged “British Summer Time” timestamps.

“The Time Zones of Satoshi Nakamoto” review also highlights an analysis of Nakamoto’s hourly activity that was published in 2011. That specific research from 2011 concludes that Satoshi must have lived in an EST time zone in the U.S. The 2018 investigation alludes to circumstantial evidence that Satoshi was a “night owl” and regularly pulled all-nighters online. Most of Nakamoto’s all-nighter periods took place in the “summer of 2010 and the month of February.”

Satoshi’s All Nighters and Cramming to Get Bitcoin Complete

One of the most compelling findings in the 2018 research suggests that Satoshi rushed toward the end of his task, after taking a brief period of time off from the Bitcoin project. The findings show that Nakamoto put little to no activity into anything Bitcoin-related during the 2010 months of March, April, and May. Then, all of a sudden, in the summer of 2010, there was a huge burst of online activity from Bitcoin’s creator.

“This is the behaviour of someone who at the end of February found himself with an all-consuming task to complete by the end of May and then had practically unlimited free time, including the latitude to work into the small hours of the night, until the following October,” the armchair detective dubbed ‘In Search Of Satoshi’ concluded on February 13, 2018.

The latest 2020 research suggesting that Satoshi lived in London and the 2018 research does show evidence weighs heavier toward a UK-based home location. In the opinion of Karaivanov and his team’s research, London definitely holds the highest probability.

“Put together, his writing style, his activity pattern, and the Genesis block message, blatantly points to the capital of England as the most likely candidate,” Karaivanov’s findings deduce.

Meanwhile, a number of cryptocurrency advocates discussed Karaivanov’s time zone study and questioned the reliability of his findings. For example, Jorge Stolfi, a professor of computer science commented on the theory after the study was published on the Reddit forum r/btc.

Stolfi said the “’London’ hypothesis implies that he worked on bitcoin straight from 17:00 to 03:00 without dinner. The ‘US/Eastern’ hypothesis would imply that he started working on it at noon and had dinner after about 22:00. The “US/Western” hypothesis would imply that he worked all day from 08:00 to about 20:00 and practically did not work after dinner.”

Stolfi added:

While all these are possible, if anything this data would confirm that he was in the US, probably in the Western part during that time — agreeing with the PDF metadata.

What do you think about the study that assumes Satoshi lived in London while creating Bitcoin? Let us know what you think about this enigmatic subject in the comments section below.

The post New Research Suggests Satoshi Nakamoto Lived in London Creating Bitcoin appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2HALy1d

via IFTTT

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3mctVny

via IFTTT

Market Wrap: Bitcoin Loses Momentum at $19.4K; Ethereum Fees Increasing

from Google Alert - Bitcoin https://ift.tt/39fqqJj

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/39brb6i

via IFTTT

Lolli integrates 'free Bitcoin' functionality for eBay before Black Friday

from Google Alert - Bitcoin https://ift.tt/36aXoc9

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3q1OTrD

via IFTTT

Form D/A Galaxy Institutional Bitcoin Fund Lp

from Google Alert - Bitcoin https://ift.tt/3m2C8KW

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3ma2URD

via IFTTT

Why Is Bitcoin Near All-Time Highs? Where Does It Go From Here?

from Google Alert - Bitcoin https://ift.tt/3nY0SEJ

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/2V1OU0z

via IFTTT

Featured Post

BITCOIN (BTC) blockch✂️ain FORKS

🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧 Bitcoin Cash: Forked at Block 478558, 1 August 2017, For each 1 BTC you get 1 BCH Bytether: Cross for...