There are so many benefits to using a cryptocurrency, that it would seem foolish to neglect such an invention. For example, it allows you to send money anywhere in the world in an instant, with basically no fees involved. Everyone can be included in the financial system, it will change the way we interact with money, it can prevent fraud, and much more.

Saturday, March 31, 2018

Bitcoin bust? Price falls below $7000 – a third of its value earlier this year

from Google Alert - Bitcoin https://ift.tt/2J9YAyz

CZ, Binance CEO puts Bitcoin [BTC] prices in perspective!

from Google Alert - Bitcoin https://ift.tt/2pUCS9g

Intel patents a Bitcoin [BTC] mining hardware accelerator to minimize power consumption

from Google Alert - Bitcoin https://ift.tt/2J80DDt

Bitcoin Is Ideal for Countries Adopting a Passive Monetary Policy

from Google Alert - Bitcoin https://ift.tt/2E9Bqop

These Are the Worst Performing Cryptocurrencies of 2018 – So Far

from Google Alert - Bitcoin https://ift.tt/2J7xcBr

Why ransomware often demands small amounts of Bitcoin

from Google Alert - Bitcoin https://ift.tt/2pVw1w5

Bitcoin Cash Gets the Axe – KuCoin Removes BCH Trading Pairs, Citing User Feedback

from Google Alert - Bitcoin https://ift.tt/2pYkZ9E

Company Enables Artists to Sell Unlimited Concert Tickets by Using Blockchain-Powered VR

from Google Alert - Blockchain https://ift.tt/2IhM9zI

Bank of England to Test Blockchain Tech in Domestic Payments System

from Google Alert - Blockchain https://ift.tt/2pV5waU

Will the Blockchain Overhaul HR? Let's Hope So

from Google Alert - Blockchain https://ift.tt/2IiYcNa

How to use blockchain to do good in a world where nobody trusts each other

from Google Alert - Blockchain https://ift.tt/2pSXlvL

Blockchain Technology Could Help Da Vinci's Artwork Auctions

from Google Alert - Blockchain https://ift.tt/2IhM6nw

PBOC to Strengthen Cryptocurrency Regulations in 2018

The People’s Bank of China (PBOC)’s Institute of International Finance has released a report identifying cryptocurrencies as a top priority for 2018. The document claims that widespread retail investment into cryptocurrencies has the potential to pose systemic risk to the Yuan, and also emphasizes the PBOC’s intention to expand its research and development into cryptocurrencies.

Also Read: FBI Warns of Crypto Scammers Posing as Exchange Support Staff

Strengthening of Virtual Currency Regulations Top Chinese Monetary Policy for 2018

The report emphasizes the risks perceived to be associated with virtual currencies by the Chinese government – specifically the potential for price volatility to manifest systemic risk to the yuan in the event of widespread retail investment, the potential for criminal misuse, and the lack of a robust regulatory framework providing consumer protections to investors.

The report emphasizes the risks perceived to be associated with virtual currencies by the Chinese government – specifically the potential for price volatility to manifest systemic risk to the yuan in the event of widespread retail investment, the potential for criminal misuse, and the lack of a robust regulatory framework providing consumer protections to investors.

The document advocates the strengthening of China’s regulatory framework regarding cryptocurrencies, calling for the development of a comprehensive procedure for monitoring the circulation of virtual currencies. The report also supports propositions that the G20 should lead efforts to establish a global regulatory framework with regards to digital currencies, advocating information sharing and cooperation between international regulatory institutions regarding digital currencies.

The report asserts that the popularity of cryptocurrencies has grown rapidly – attributing their dramatic rise to global demand for bitcoin’s utility of providing greater efficiency and reduced costs in conducting transactions.

The report also emphasized the targeting of MLM and pyramid schemes using cryptocurrencies as a priority for Chinese regulators.

PBOC Convenes Monetary Policy Conference

The PBOC also recently published a document providing a synopsis of the topics discussed during the central bank’s recent telephone conference on national currency, gold, silver, and monetary policy.

The PBOC also recently published a document providing a synopsis of the topics discussed during the central bank’s recent telephone conference on national currency, gold, silver, and monetary policy.

The document emphasizes the PBOC’s desire to expand its efforts asserts in the “promot[ing] the R&D of the central bank’s digital currency” as a primary monetary policy for 2018, indicating that the development of a long-rumored Chinese national cryptocurrency is still a top priority for China’s central bank.

The PBOC also described “the rectification of various […] virtual currency” markets as a desired policy outcome, emphasizing the need for strengthened anti-money laundering processes.

Do you think that China will be able to effectively enforce its cryptocurrency ban? Share your thoughts in the comments section below!

Images courtesy of Shutterstock

At news.Bitcoin.com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post PBOC to Strengthen Cryptocurrency Regulations in 2018 appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2IgMfre

via IFTTT

Bitcoin's Biggest Winners—or Losers—Are Likely to Be Men

from Google Alert - Bitcoin https://ift.tt/2GlOih6

HODL For GODL: Bitcoin Investors Wait Just 189 Days For 100% Returns

from Google Alert - Bitcoin https://ift.tt/2GLCVyJ

Japanese Crypto Exchange GMO Vows to Improve After Regulator Orders Upgrades

The cryptocurrency exchange subsidiary of the Japanese internet giant GMO has detailed its plans to improve its operations. GMO Coin has submitted a business improvement report to the country’s financial regulator. GMO Internet has also set up an information security audit office for the entire group.

Also read: Japan’s DMM Bitcoin Exchange Opens for Business With 7 Cryptocurrencies

GMO Strengthens Operations and Security

GMO announced on Friday the establishment of its Group Information Security Audit Office “to strengthen information security management and audit function in the whole group.” The company wrote:

GMO announced on Friday the establishment of its Group Information Security Audit Office “to strengthen information security management and audit function in the whole group.” The company wrote:

We will protect important customer information from increasingly sophisticated cyber-attacks by our highly secured countermeasures and pursue to improve group information security literacy and foster security personnel.

The Japanese Financial Services Agency (FSA) issued a business improvement order to GMO Coin, GMO Internet’s cryptocurrency exchange subsidiary, on March 8 after conducting an inspection. The agency began inspecting all crypto exchanges after the hack of Coincheck, one of Japan’s largest crypto exchanges. The FSA mandates the “Implementation of Effective System Risk Management Structure” under Article 63-16 of the Law on Funds Payment. GMO Coin obtained a license from the FSA in September of last year.

The Japanese Financial Services Agency (FSA) issued a business improvement order to GMO Coin, GMO Internet’s cryptocurrency exchange subsidiary, on March 8 after conducting an inspection. The agency began inspecting all crypto exchanges after the hack of Coincheck, one of Japan’s largest crypto exchanges. The FSA mandates the “Implementation of Effective System Risk Management Structure” under Article 63-16 of the Law on Funds Payment. GMO Coin obtained a license from the FSA in September of last year.

Headquartered in Tokyo, GMO is one of Japan’s largest internet companies. It operates GMO Click, which is “The largest FX trading services provider for retail investors in Japan,” the company’s website states. Last year, GMO also began its crypto mining operations.

GMO’s Business Improvement Plan

Following the FSA’s order, GMO Coin submitted a business improvement plan as required by the agency. The exchange will report its progress and implementation status to the regulator “every month by the 10th day of the following month in writing until the implementation of the business improvement plan” is complete, GMO Coin detailed. The first reporting date is the last day of March.

Following the FSA’s order, GMO Coin submitted a business improvement plan as required by the agency. The exchange will report its progress and implementation status to the regulator “every month by the 10th day of the following month in writing until the implementation of the business improvement plan” is complete, GMO Coin detailed. The first reporting date is the last day of March.

Specifically, GMO Coin plans to establish an effective risk management system. “The management team analyzed and investigated the root causes of system failures, formulated concrete countermeasures, and responded to the actual situation of business expansion,” the company described.

The business improvement plan includes “(1) business management systems, (2) contingency corresponding readiness plan [in] the event of a failure, (3) information security, cyber security management posture, and (4) quality control and configuration management systems,” GMO Coin outlined.

The business improvement plan includes “(1) business management systems, (2) contingency corresponding readiness plan [in] the event of a failure, (3) information security, cyber security management posture, and (4) quality control and configuration management systems,” GMO Coin outlined.

In its announcement, the exchange stated that they “sincerely apologize for the inconvenience and worry that our customers and stakeholders have experienced,” adding:

We deeply reflect on taking this administrative punishment seriously and will steadily implement improvement plans to strengthen and enhance the system risk management system to further enhance the service that customers can feel secure and safe [with].

What do you think of GMO Coin’s business improvement plan? Let us know in the comments section below.

Images courtesy of Shutterstock, Nikkei, and GMO.

Need to calculate your bitcoin holdings? Check our tools section.

The post Japanese Crypto Exchange GMO Vows to Improve After Regulator Orders Upgrades appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2GYsANp

via IFTTT

Invox Finance: A Blockchain Based Solution For Peer-to-Peer Invoice Financing

from Google Alert - Blockchain https://ift.tt/2GqR94z

Singapore Launches Blockchain Challenge with Funding Prizes

from Google Alert - Blockchain https://ift.tt/2pSJpSt

Bitcoin crisis continues with another huge price drop

from Google Alert - Bitcoin https://ift.tt/2uFuwIc

PR: VR Casino OKO Is a New Project Based on OKOIN Tokens

This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

VR Technology, the founder of the OKOIN, is launching a new project based on the same name token – VR Casino OKO. This is the third blockchain project, which tokenomics is based on the OKOIN tokens. Two predecessors are VR Platform OKO (the platform for distributing interactive VR adult movies) and OKO Pay (the payment system for VR Technology partners through which they can accept OKOIN tokens for goods and services). It is noteworthy that all three projects are not interchangeable. Each of them is independent, and they work in parallel, thereby expanding the reach of the audience and increasing the value, stability and liquidity of the OKOIN token.

VR Casino OKO project

VR Casino OKO is a unique project that combines the atmosphere of the game in real casinos with the availability of online gambling and transparency of the blockchain. The project is based on the VR OKO helmet whose sales have already exceeded 70,000 units. In the future VR Technology plans to make the system available for other VR-devices (Oculus Rift, HTC VIve and others), provided that their hardware and software will meet the technical requirements of the project.

In more than 40 countries casinos are prohibited. As a result, online casinos are trying to occupy a free niche. According to the analytical company Newzoo the gross profit of online casinos stably increases by 8-10% per year and is more than 43.7 billion euros by 2017.

At the same time, online casinos have shortcomings. The main one is that the win or loss is determined by the work of the computer program algorithm and it’s honesty and transparency is questionable. In addition, the monitor screen and software interface can not convey the atmosphere and glow of the passions of the gambling establishment.

More modern formats of online gambling – VR-casino partially solve the problem of visualization. However, the user still sees virtual reality computer rendering in the helmet (painted, artificial casino, albeit in very high quality). And the winning of bets is determined by a computer program.

The main difference between the VR Casino OKO project and its analogues is that using the VR helmet the user sees a live broadcast from the VR cameras installed in this casino. Cameras have a 180 degrees viewing angle and show the table, the croupier and everything that happens in real time.

In addition to the effect of presence, the user of the VR Casino OKO can also bets in real time. To do this OKOIN tokens are used as a casino chips. Smart contracts make the game as transparent and fair as possible.

ICO project will be held in parallel with the ICO project OKOIN: from March 25 to April 25 (due to the fact that the tokens in both projects are the same). Accordingly, the affiliate program, the bounty program and the played tickets for the private party OKO Stars are equally relevant.

Special offers

Offer #1

Valid March 25 to April 10, 2018

Add yourself to the “List of the First” and buy OKOIN tokens for more than 20 ETH at a starting price of $1.

Important: other sales do not apply for the list of the first!

Offer #2

Valid March 25 to April 25, 2018

Buy OKOIN tokens and get bonuses:

1 ETH and more: +30% bonus

3 ETH and more: +40% bonus

5 ETH and more: +50% bonus

15 ETH and more: VIP ticket to the OKO Stars party as a gift

Contact Email Address

ico@okoin.io

Supporting Link

https://oko.casino/?utm_source=bitcoincom&utm_medium=article&utm_campaign=okocasino

This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

The post PR: VR Casino OKO Is a New Project Based on OKOIN Tokens appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2H0Yngs

via IFTTT

FBI Warns of Crypto Scammers Posing as Exchange Support Staff

The Federal Bureau of Investigation (FBI) has published a document seeking to warn citizens of the increasing prevalence of scams executed through fraudulently posing as technical support staff for a company. The FBI’s notes that virtual currencies are becoming “increasingly targeted by tech support criminals.”

Also Read: Mailchimp Latest Company to Ban Cryptocurrency Advertising

Cryptocurrency Tech Support Theft on the RIse

The FBI has issued a warning emphasizing the “widespread” nature of “Tech Support Fraud” – which “involves a criminal claiming to provide customer, security, or technical support in an effort to defraud unwitting individuals.” The FBI’s IC3 division reports an increase in tech support fraud of 86% during 2017 when compared with 2016 – with last year’s claimed losses “amount[ing] to nearly $15 million.”

The FBI has issued a warning emphasizing the “widespread” nature of “Tech Support Fraud” – which “involves a criminal claiming to provide customer, security, or technical support in an effort to defraud unwitting individuals.” The FBI’s IC3 division reports an increase in tech support fraud of 86% during 2017 when compared with 2016 – with last year’s claimed losses “amount[ing] to nearly $15 million.”

The report states that “Some recent complaints [have] involve[d] criminals posing as technical support representatives for […] virtual currency exchangers,” with individual victim losses often in the thousands of dollars.”

The FBI states that “Criminals pose as virtual currency support,” luring “Victims to contact fraudulent virtual currency support numbers usually located via open source searches. The fraudulent support asks for access to the victim’s virtual currency wallet and transfers the victim’s virtual currency to another wallet for temporary holding during maintenance. The virtual currency is never returned to the victim, and the criminal ceases all communication.”

In other instances, criminals conducting tech support fraud “who have access to a victim’s electronic device use the victim’s personal information and credit card to purchase and transfer virtual currency to an account controlled by the criminal.”

FBI Pressures Social Media Networks to Ban Cryptocurrency Ads

The FBI appears to be taking increasing action in the cryptocurrency sphere, with reports indicating that the institution has been actively working to persuade leading social media platforms to crackdown on the advertising of cryptocurrencies and ICOs.

The FBI appears to be taking increasing action in the cryptocurrency sphere, with reports indicating that the institution has been actively working to persuade leading social media platforms to crackdown on the advertising of cryptocurrencies and ICOs.

Last month, a senior investigator at the Manitoba Securities Commission and the chairman of Canada’s Binary Options Task Force, Jason Roy, revealed that Canadian and U.S. authorities had been pressuring Facebook to enact a prohibitive policy with regards to cryptocurrency advertising.

Mr. Roy stated “What happened is that Canada’s Binary Options Task Force, as well as the FBI, explained to Facebook what the concerns were and that these types of ads are leading to people becoming victims. We’ve been talking to Google and had similar discussions and are waiting for them to take similar action.”

Have you ever fallen victim to a tech support scam? Share your experience in the comments section below!

Images courtesy of Shutterstock

Want to create your own secure cold storage paper wallet? Check our tools section.

The post FBI Warns of Crypto Scammers Posing as Exchange Support Staff appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2IimU00

via IFTTT

Blockchain is the key to fair distribution of wealth in the sharing economy

from Google Alert - Blockchain https://ift.tt/2J766dH

'Bitcoin Is Dead'

from Google Alert - Bitcoin https://ift.tt/2IiIwtr

Hollywood exec, entrepreneur unite to launch entertainment-focused blockchain

from Google Alert - Blockchain https://ift.tt/2E90XOx

“Blockchain-In-A-Box” Becomes the Latest Kid in Subutai's Family of Blueprints

from Google Alert - Blockchain https://ift.tt/2Ec2fZm

Huobi Officially Launches in South Korea with 100 Cryptocurrencies

Huobi has officially launched in South Korea. The platform facilitates the trading of 100 cryptocurrencies and 208 markets. The exchange is also creating an investor protection fund and program to immediately compensate for any losses that are not investor error.

Also read: Japan’s DMM Bitcoin Exchange Opens for Business With 7 Cryptocurrencies

Huobi Korea Launched

Huobi Korea, a subsidiary of the Beijing-based crypto trading service provider Huobi, announced that it has officially launched on March 30.

“Huobi Korea will list 100 coins and 208 markets (33 USDT markets, 98 BTC markets, 77 ETH markets),” Zdnet detailed. The exchange stated that it stores 98% of its customer assets in cold wallets. Furthermore, the exchange’s internal access procedure has been strengthened, according to the publication. “In order to open the repository, we have added security to complex procedures that require multiple people to authenticate together,” the news outlet conveyed, and quoted an official of the exchange explaining:

We are also creating an investor protection fund and run an investor protection program to immediately compensate for losses that are not investor error.

100 Cryptos

Huobi confirmed on Thursday that “In Huobi Korea, 100 coins can be traded,” noting that the exchange “will try to support more and more coins trading.”

The supported cryptocurrencies, according to Huobi, include DAT, DBC, DGD, DTA, EDU, ABT, ACT, ADX, AIDOC, APPC, AST, BAT, BCD, BCH, BCX, BIFI, BLZ, BTC, BTG, BTM, CHAT, CMT, CTXC, CVC, LINK, LSK, LTC, LUN, MANA, MCO, MDS, ICC, IOST, ITC, ICC, IOST, ITO, EKO, ELA, ELF, ENG, EOS, ETC, ETH, EVX, GAS, GNT, GNX, MTP, MTL, MTN, MTX, NAS, NEO, OCN, OMG, ONT, OST, PAY, POWR, PROPY, QASH, QSP, QTUM, QUN, RCN, RDN, REQ, RPX, RUFF, SALT, SBTC, SMT, SNC, SNT, SOC, SRN, STK, STORJ, SWFTC, THETA, TNB, TNT, TOPC, TRX, USDT, UTK, VEN, WAX, WICC, WPR, XEM, XRP, YEE, ZEC, ZIL, ZLA, and ZRX.

The supported cryptocurrencies, according to Huobi, include DAT, DBC, DGD, DTA, EDU, ABT, ACT, ADX, AIDOC, APPC, AST, BAT, BCD, BCH, BCX, BIFI, BLZ, BTC, BTG, BTM, CHAT, CMT, CTXC, CVC, LINK, LSK, LTC, LUN, MANA, MCO, MDS, ICC, IOST, ITC, ICC, IOST, ITO, EKO, ELA, ELF, ENG, EOS, ETC, ETH, EVX, GAS, GNT, GNX, MTP, MTL, MTN, MTX, NAS, NEO, OCN, OMG, ONT, OST, PAY, POWR, PROPY, QASH, QSP, QTUM, QUN, RCN, RDN, REQ, RPX, RUFF, SALT, SBTC, SMT, SNC, SNT, SOC, SRN, STK, STORJ, SWFTC, THETA, TNB, TNT, TOPC, TRX, USDT, UTK, VEN, WAX, WICC, WPR, XEM, XRP, YEE, ZEC, ZIL, ZLA, and ZRX.

Korean Won Support Coming Soon

As for the Korean won trading, Huobi Korea wrote, “the KRW market is in the process of being prepared and will be available soon.”

As for the Korean won trading, Huobi Korea wrote, “the KRW market is in the process of being prepared and will be available soon.”

The lack of won trading is likely due to the South Korean regulation which enforced the real-name system at the end of January. Since its implementation, Korean banks have only been issuing virtual accounts to the country’s largest four exchanges – Upbit, Bithumb, Coinone, and Korbit. However, Money Today reported on Thursday that a major bank in Korea, Shinhan Bank, is in talks to start issuing virtual accounts to a smaller crypto exchange, Coinplug.

The official from Huobi Korea was quoted by Zdnet saying:

We are concentrating our ability to prepare for the rapid opening of the Korean won market…All employees will work hard to provide safer and more stable trading services.

Huobi’s Global Expansion

Huobi is currently the third largest crypto exchange globally with a 24-hour trading volume of $1.32 billion at the time of this writing. South Korea’s largest exchange is the Kakao-backed Upbit with a trading volume of $745 million during the same time period.

Before China closed down cryptocurrency exchanges, Huobi was among the largest in the country. Today, the company has a presence in six countries – Korea, Singapore, USA, Japan, Hong Kong and China.

Last week, Huobi registered with the U.S. Financial Crimes Enforcement Network in preparation for its U.S. launch. Meanwhile, Japan’s SBI Group has stopped the capital and business tie-up with Huobi Group.

What do you think of Huobi’s launch in South Korea? Let us know in the comments section below.

Images courtesy of Shutterstock and Huobi Korea.

Need to calculate your bitcoin holdings? Check our tools section.

The post Huobi Officially Launches in South Korea with 100 Cryptocurrencies appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2GXpr0d

via IFTTT

BitcoinTV by KRBECrypto on YouTube

Starbucks To Use Blockchain To Track Beans From The Grower To The Consumer

from Google Alert - Blockchain https://ift.tt/2GmLdxB

Cisco Developing Confidential Communications Via Blockchain In Patent Filing

from Google Alert - Blockchain https://ift.tt/2pY09ar

The VC Juggernaut Awakens: Institutional Capital, Blockchain Startups, and You

from Google Alert - Blockchain https://ift.tt/2GXkp3P

Indie Movie to Debut on Qtum Blockchain, Airdrop Tokens to Viewers

from Google Alert - Blockchain https://ift.tt/2GZETsH

Seoul Mayor Aims To Launch Capital's Own Crypto, Establish Better Environment For Blockchain ...

from Google Alert - Blockchain https://ift.tt/2uzYQnx

How to Succeed at Being a Crypto & Blockchain Influencer Without Really Trying

from Google Alert - Blockchain https://ift.tt/2J6Oj6p

Indian State Government Plans to Store Residents' DNA Data on a Blockchain

from Google Alert - Blockchain https://ift.tt/2pOCpGn

Major Polish Bank To Implement Blockchain Document Storage System

from Google Alert - Blockchain https://ift.tt/2GqG3fI

Blockchain Email Banned By Mailchimp Service, Denting Fundraising

from Google Alert - Blockchain https://ift.tt/2GDEKgS

Guest commentary: Healthcare leaders, get ready for blockchain

from Google Alert - Blockchain https://ift.tt/2E8tXpE

Startup Pilots Blockchain-Based Platform to Buy/Sell Grain

from Google Alert - Blockchain https://ift.tt/2GriLqd

Facebook's Troubles Underscore Blockchains' Opportunity

from Google Alert - Blockchain https://ift.tt/2pRgPRu

Blockchain Project, Which Will Disrupt Real Estate Market

from Google Alert - Blockchain https://ift.tt/2pSoJJr

Ontology Announces Release of Open-Source Projects to Encourage Blockchain Technology ...

from Google Alert - Blockchain https://ift.tt/2uyHebB

Risk & Repeat: IBM Think 2018 highlights AI, blockchain

from Google Alert - Blockchain https://ift.tt/2uyLUhw

Hong Kong Exchange OKEx Rolls Back Futures Transactions

Hong Kong–based cryptocurrency trading platform OKEx announced on March 30 that it was rolling back on all futures transactions due to what executives deemed an “irregular sell-off.”

The exchange issued the following statement on its support page:

To prevent forced-liquidations due to price differences after the settlements in ‘bi-weekly’ and ‘quarterly’ futures contracts, we will rollback the transactions as mentioned, and all futures contracts will be delivered at 00:00 Mar 31, 2018 (Hong Kong Time). Further announcement will be made if there are any changes in delivery time.

The post explained that all weekly, bi-weekly and futures contracts would be fulfilled, but that after delivery, “all open orders” would be canceled and “all holding positions” would be closed at the delivery price. The incident allegedly caused the price of bitcoin to fall (albeit briefly) below the $5,000 mark on the exchange, which in turn led to “massive liquidations” and hundreds of contracts being “wiped out.”

One particularly scary moment occurred when a disgruntled user arrived at the exchange’s headquarters carrying a bottle of poison. The customer claimed to have lost nearly $11 million through the forced liquidations and threatened to take his own life by ingesting the substance.

OKEx says it always has “customers’ best interests at heart” and that the platform is “dedicated to providing the best products and technologies to protect [their] customers.” Following the sell-off, transactions were suspended for several hours, and executives issued an apology for what had occurred.

The team eventually posted a follow-up notice explaining what they planned to do in the future to prevent similar events from occurring again:

All the rollbacks have been completed. Withdrawal and Futures Trading will be resumed at 00:00 Mar 31, 2018 (Hong Kong time). In light of this incident, we are going to update our ‘Price limit rules’ for Futures Trading at 00:00 Mar 31, 2018 (Hong Kong Time) for better risk control. There will be more related improvements, and we will notify you in further announcements after they are launched.

Presently, all rollbacks have been completed and futures trading has resumed, but not everyone is convinced the problem has come to an end. Several customers are criticizing OKEx and its current systems, saying that they do not have the capabilities “to prevent what might be termed as the intended activities.” And others are suggesting OKEx may have been trying to manipulate bitcoin’s price through the liquidation, though the company has not yet acknowledged these charges.

At press time, bitcoin has fallen by nearly $700 from where it stood on March 29, and is now trading at approximately $6,700.

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2Ik5a4D

via IFTTT

Intel Releases Patent for New Cryptocurrency Mining Accelerator

Intel, one of the world’s largest semiconductor companies, has filed a patent for a new Bitcoin mining chip accelerator. Entitled “Bitcoin Mining Hardware Accelerator with Optimized Message Digest and Message Scheduler Datapath,” the patent was originally submitted in September of 2016, but is now being released for the first time.

Bitcoin and cryptocurrency mining has long been under scrutiny for the excessive energy it allegedly uses. Countries like Iceland, for example, admit that more energy is used to mine Bitcoin than to power its residences, while cities like Plattsburgh, New York — a once-popular haven for commercial Bitcoin mining — have imposed strict moratoriums to lessen miners’ growing needs and the surging costs of electricity.

Intel claims to have found a more reasonable and cost-effective way to mine bitcoins. The patent says the product can decrease energy use by up to 35 percent while lowering financial requirements and mining more bitcoins in the process.

The document reads:

Because the software and hardware utilized in Bitcoin mining uses brute force to repeatedly and endlessly perform SHA-256 functions, the process of Bitcoin mining can be very power-intensive and utilize large amounts of hardware space. The embodiments described herein optimize Bitcoin mining operations by reducing the space utilized and power consumed by Bitcoin mining hardware.

Intel explains that one of the most expensive and rigorous steps involved in any mining venture is finding the 32-bit field. The value is set so that the block hash contains a nonce, or a solid set of zeros. After computation is complete, these zeros are attached to the “hash of the transaction hashes in the blockchain” and other headers.

The traditional 256-bit hash that the document discusses is less than a “pre-defined threshold value.” There are two primary computational blocks involved: a message scheduler and a message digest. Both blocks work together to combine several 32-bit words and 32-bit additions, which can thus bring energy use down.

Several problems exist, however, within the present mining community. Energy costs in most of the United States are increasing, while other nations like China — prime locations for mining operations due to their low-priced energy supplies — have sought to slow cryptocurrency innovation by “clamping down” on Bitcoin miners or limiting available energy.

Perhaps the largest problem stems from bitcoin’s current price. At press time, one bitcoin is trading for roughly $6,600 — a massive drop from the $8,000+ mark seen earlier this week. Figures like Fundstrat’s Thomas Lee now say that Bitcoin mining is no longer profitable, with most miners either breaking even or falling short between what they earn and what they’ve spent to extract coins.

Randy Copeland, an Intel partner and the president of Velocity Micro, says that Intel’s new accelerator could change things for the better. Speaking with CRN, Copeland explains, “Once this new Intel technology comes to market, more people will mine again because it’s profitable again, driving down the market value of the coins and finding a new market balance that will again put locations with lower electricity costs back at the advantage.”

This is not Intel’s first attempt to enter the cryptocurrency arena. Last May, the company partnered with healthcare transaction service provider PokitDok to help bring blockchain technology to the healthcare industry. Executives also joined hands with Chinese media and tech firm Tencent in September to collaborate on a new blockchain solution.

Later in October, Intel partnered with hardware wallet developer Ledger to store digital currency on the company’s platform.

Intel’s actions could prove to be significant. Patents among some Bitcoin companies have been deemed “unethical,” as the original Bitcoin software is available freely as open-source software. In addition, patents for Bitcoin mining products present concerns regarding the decentralized nature and competitiveness of the industry. If one company is able to use significantly less resources and thereby operate more efficiently, that venture may wind up the single or dominant party, while the rest make a permanent exit — a situation that could result in reduced decentralization and security.

The recent Blockchain Defensive Patent License (BDPL) is seeking to provide a more open arena for Bitcoin miners. Should a Bitcoin- or blockchain-based company enter the agreement, they must share all their patents with “other license holders” as long as those holders are also members. The BDPL imposes strict regulations that deny blockchain companies specific rights to certain patents or products, and penalizes “licensees who attack the patents licensed” to other members.

It will certainly be interesting to see if Intel, with its latest technology, decides to follow in the spirit of other Bitcoin mining companies and become the BDPL’s newest affiliate.

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2IhHNZh

via IFTTT

Cryptocurrency Exchange Bittrex Introduces Stable Tether-to-TrueUSD Pairing

Bittrex, a U.S.-based cryptocurrency exchange, has issued a trading pair between tether (USDT) and TrueUSD (TUSD), two stable tokens pegged to the U.S. dollar. While tether is issued by Tether, TrueUSD is issued by TrustToken.

Unlike other cryptocurrencies, stable tokens are pegged to the value of traditional money. In this case, tether and TrueUSD are both pegged to the U.S. dollar, so that one token is worth one dollar.

Stable tokens are useful in that they protect traders from market volatility. The question is, why would one exchange offer two types of dollar tokens? The answer is, it would allow traders who are worried about the long-term viability of one token over the other to hedge their bets by owning one or the other or a little of both. By a similar logic, listing two tokens could also protect the exchanges, particularly those like Bittrex, that do not carry crypto-fiat pairs and depend on stable tokens to maintain liquidity.

Tether vs. TrueUSD: A Brief Comparison

Tether is closely linked to the cryptocurrency exchange Bitfinex, and questions still linger around whether the $2.3 billion in tether issued so far are backed by actual dollars. So far, no third-party audit has taken place to prove that is the case, and Bitfinex has been opaque about its banking relationships.

Also, because the identities of the people who own tether are not always clear, the movement of the token across national borders has raised concerns about money laundering and, consequently, Tether’s risk of being shut down at some point.

In contrast, TrustToken, which began trading on Bittrex earlier this month, is marketing itself as a safer bet. “TrueUSD offers token-holders full collateral, regular auditing, and legal protections to redeem TrueUSD for USD,” the company wrote in a blog post.

Also, while Tether is built on the Omni Layer (formerly Mastercoin), a platform that issues tokens on the Bitcoin blockchain, TrueUSD is an ERC20 token controlled by a smart contract on the Ethereum blockchain. TrustToken says that when users send in fiat, their money is kept in an escrow account that only they have access to, and that they can reclaim their underlying fiat at any time.

At the moment, TrustToken is applying for a license in order to serve as a money service business to boost trader confidence that TrueUSD is backed by actual dollars.

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2E80Q5P

via IFTTT

Op Ed: France’s Emerging Cryptocurrency Policy Appears Optimistically Vague

On March 19, 2018, in an op-ed published by the French news website, Numerama, France’s Minister of Finance and Economics, Bruno Le Maire wrote what appears, at least at first glance, to be an uncharacteristically optimistic exposition on the profound and pioneering nature of cryptocurrency and blockchain technology:

“A revolution is underway, of which bitcoin was only the precursor. The blockchain will offer new opportunities to our startups, for example with the Initial Coin Offerings (ICO) that will allow them to raise funds through ‘tokens,’ crypto-actives or not. It promises to create a network of trust without intermediaries, to offer increased traceability of transactions and, overall, to make the economy more efficient.”

The op-ed is a message to the French public that this emerging technology will be an agent of change — both disruptive and beneficial. According to Le Maire, blockchain technology and cryptocurrencies “could upset daily practices in the banking and insurance sectors, financial markets, but also patents and certified acts.” He goes on to warn what has been echoed by leaders of other nations, that there should be anticipated consequences for traditional players.

“Let’s not be mere spectators: become actors in this revolution,” he urged. Le Maire goes on to state that France’s policy should be benevolent yet cautious. He expressed weariness for the chaotic nature of decentralization by questioning speculative products, investor security and the ever-present possibility that the technology could be used to launder or fund criminal activities.

“Clarifying the law to attract innovation, identify risks without hindering our ecosystem, that's our approach,” wrote Le Maire. He goes on to advocate for a former French central bank governor, Jean-Pierre Landau, who has been assigned to further investigate cryptocurrencies to formulate a proposal for a more navigable regulatory framework.

The op-ed concludes with, “Il s’agit là du rôle de la France: Être force de proposition pour construire le monde de demain,” which loosely translates to, “This is the role of France: Be proactive in building the world of tomorrow."

Blockchain Bisque

Le Maire’s op-ed is uncharacteristic for two reasons. First, the news website, Numerama plays to an audience who are in favor of the open source movement. Founded as Ratiatum in 2002, the publication originally focused only on peer-to-peer and culture-related topics until it was rebranded as Numerama. While Numerama is said to defend the “free-sharing culture” and “respect of privacy,” a reader (Mmastoc) complained in the comments section of the mismatch between Numerama and the blunted public-announcement style of Le Maire’s op-ed, “For pity’s sake, I beg you, not the government soup.”

The sentiment is repeated in some way by several other commentators; the point being, that a publication as critical of centralized authority as Numerama publishing a public message about cryptocurrency adoption by the central government gives an overly optimistic, if not artificial and incomplete, view of government policy.

The other reason why the op-ed comes across as ineffectual is its vague optimism toward less cryptocurrency regulation. Based on what has happened earlier this year in France and other nations, Le Maire’s cryptocurrency policy, and by association the French government’s, has tended to lean hard toward heavier regulation.

For instance, Jean-Pierre Landau — the central banker for whom Le Maire advocates in the op-ed and has entrusted to build a regulatory framework for cryptocurrency — is a notable Bitcoin skeptic who denounced the cryptocurrency back in 2014 in his own op-ed for the Financial Times. Landau’s argument is that currencies need central banks to be successful so that adjustments to the monetary supply can be made; therefore, bitcoin’s scarcity (small supply) will be insufficient to satisfy demand and, as a result, the economy as a whole.

While it might not be clear what Landau thinks four years later, Le Maire appointed Landau to lead a working group for the purpose of regulating cryptocurrencies back in the middle of January 2018.

G20 Discussions

Shortly after Le Maire’s op-ed, world leaders met in Argentina for the G20 Summit and, specifically, the greatest event for cryptocurrency regulation so far in 2018. Despite the changing views of Mike Carney, governor of the Bank of England and chairman of the Financial Stability Board (FSB), who has eased up on cryptocurrencies, France has advocated for a regulatory framework for cryptocurrencies that they are now pursuing with Germany. This cooperation is evidence that the call from German central banks for effective regulation of virtual currencies on a international scale is an opinion shared by many French authorities.

These developments, no doubt, are linked to an increased regulatory focus on cryptocurrencies in other countries such as China, South Korea and the U.S. Future cryptocurrency regulation will almost certainly require international cooperation for it to move forward ,given these recent developments and the cross-border attributes of cryptocurrency in general.

The G20 ultimately determined that cryptocurrencies should be regulated as property for now, though it is likely they will be regulated as their own unique asset class as time moves on. World leaders also left the G20 with an agreed upon notion to have effective regulations in place by July 2018.

French Liberty?

If France has recently decided to cultivate a suitable environment for cryptocurrency, credit is due in large part to Laure de La Raudière. Raudière is a republican who represents the Eure-et-Loir department in the National Assembly of France (lower house of the bicameral parliament of France).

She was also appointed in early February to lead the National Assembly’s “Mission d’information.” The purpose of the mission has been to investigate blockchain technology in France and abroad to produce reports that will inform legislators on topics related to how the technology can be used and should be regulated. The mission is expected to take no more than six to seven months since February, meaning it should be wrapping up around the time the G20 world leaders will reconvene for regulation consensus.

Though French authorities appear determined not to let the technological innovation of cryptocurrencies and blockchain technology to pass them by, time will tell where they will inevitably fit on the global regulation spectrum. L’Autorité des Marchés Financiers (AMF) has also gone after specific cryptocurrency players who are not registered with the AMF.

In an article from February, Raudière was quoted as stating something much more optimistic and yet, less vague,

To avoid mis-legislating, you have to understand. I have always enrolled in this approach of technology education, focusing on highlighting the repercussions of the prohibition of a technology. For example, at the time of the HADOPI debate, amendments aimed at banning peer-to-peer technology; it revealed a total misunderstanding that technology can be used to achieve illegal things but also to accomplish extremely positive things.Most of the time, it's not the technology you have to ban, but the way it's used.

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2pStiUo

via IFTTT

Criminal Bitcoin Trader Found Guilty of Money Laundering in Arizona

from Google Alert - Bitcoin https://ift.tt/2pSDcWO

Is The Bitcoin Price Finally Reaching Its Bottom?

from Google Alert - Bitcoin https://ift.tt/2pRR7fF

What Could Turn Bitcoin, Ripple, Ethereum, And Litecoin Around?

from Google Alert - Bitcoin https://ift.tt/2uztVYn

BitPay Merchants Can Now Accept Bitcoin Cash Payments

from Google Alert - Bitcoin https://ift.tt/2pRxsfI

Bitcoin Testing Its February Low Of $6600

from Google Alert - Bitcoin https://ift.tt/2uz9Zot

Bitcoin, Ethereum, Bitcoin Cash, Ripple, Stellar, Litecoin, Cardano, NEO, EOS: Price Analysis ...

from Google Alert - Bitcoin https://ift.tt/2GmoMZp

Bitcoin Price Watch: Argh! Another Massive Drop

from Google Alert - Bitcoin https://ift.tt/2pShceJ

Bitcoin is Crashing... Not Just Dropping

from Google Alert - Bitcoin https://ift.tt/2J7Ci0H

Mesa bitcoin trader convicted of money laundering

from Google Alert - Bitcoin https://ift.tt/2pRYyn1

Nvidia CEO maintains that cryptocurrency mining “is not their business”

from Google Alert - Bitcoin https://ift.tt/2Gq9xur

Governments lose control of exchange rates as bitcoin traders evade border controls

from Google Alert - Bitcoin https://ift.tt/2uyvXIm

Bitcoin ATM Installed in Georgia Amid Growing Interest in Crypto

from Google Alert - Bitcoin https://ift.tt/2uAo8C2

OKEx to Roll Back 'Irregular' Futures Trades After Bitcoin Price Crashes Below $5000

from Google Alert - Bitcoin https://ift.tt/2pSf7iN

So you purchased and sold some bitcoin. Are you going to have to pay taxes?

from Google Alert - Bitcoin https://ift.tt/2pOCwSj

Newegg Canada Now Accepts Bitcoin Payments Through BitPay

from Google Alert - Bitcoin https://ift.tt/2GLUtue

Even as Bitcoin Languishes, Telegram Raises $1.7 Billion Ahead of Largest ICO Ever

from Google Alert - Bitcoin https://ift.tt/2uAfm6N

Two More Japanese Bitcoin Exchanges Will Shut Down

from Google Alert - Bitcoin https://ift.tt/2uyNgJh

Abra CEO: “Bitcoin Price to Skyrocket Soon”

from Google Alert - Bitcoin https://ift.tt/2J6onIc

Intel Files Patent For Energy-Efficient Bitcoin Mining Hardware

from Google Alert - Bitcoin https://ift.tt/2GksQJj

Tale of Two Transcripts: Jury Believes Feds, Convicts Mesa Bitcoin Trader 'Morpheus Titania'

from Google Alert - Bitcoin https://ift.tt/2GqM5wS

Gazprombank to Try Crypto Deals in Switzerland

Gazprombank, one of Russia’s largest financial institutions, is planning to perform some cryptocurrency deals by the end of the year. According to one of its top managers, the bank is responding to demand from “substantial clients”. The pilot transactions will be conducted through its subsidiary in Switzerland.

Also read: New Bill Aims to Allow Crypto Payments in Russia

Working on Procedures, Looking into Options

The state-owned Gazprombank may try to conduct some cryptocurrency transactions on behalf of its customers as early as this year, Russian media reported. They will be channeled through its Swiss-based subsidiary, Deputy CEO Alexander Sobol told Interfax news agency.

“These will be pilot deals, not on a large scale. Some substantial private clients have asked for this kind of services,” Sobol explained. The bank is currently looking into different options to meet that demand. Gazprom’s subsidiary in Switzerland is studying the opportunities there. The alpine country has implemented more liberal regulations, he noted.

“These will be pilot deals, not on a large scale. Some substantial private clients have asked for this kind of services,” Sobol explained. The bank is currently looking into different options to meet that demand. Gazprom’s subsidiary in Switzerland is studying the opportunities there. The alpine country has implemented more liberal regulations, he noted.

According to the high-ranking representative, the Russian bank has not yet developed crypto-related procedures. No decision has been taken to offer the new services to regular customers. However, Alexander Sobol stressed that the bank’s management is actively following [crypto] developments.

Gazprombank is the third-largest bank in the Russian Federation. It offers retail, corporate, investment and depositary services, as well as clearing and settlement products. It also deals with securities and forex instruments. Gazprombank owns shares in three other Russian banks and is operating in Belarus and Switzerland through subsidiaries.

Breaching AML Rules in Switzerland

About a month ago the Swiss Financial Market Supervisory Authority (FINMA) banned Gazprombank (Switzerland) from attracting new private customers. The regulator found deficiencies in its anti-money laundering procedures. The agency inspected more than 30 banks within an investigation which began in 2016 after the Panama Papers revelations. FINMA said that the bank had breached its own AML requirements between 2006 and 2016.

The Swiss subsidiary was founded as Russische Kommerzial Bank AG in 1992. It was renamed after its acquisition by Gazprombank in 2009. The bank specializes in financial operations related to the bilateral trade between Russia and Switzerland. It also provides services to Swiss companies investing in the Russian Federation and the CIS countries.

Cryptocurrency deals are not yet regulated in the Russian Federation. However, two draft laws aimed to change the status quo have been introduced in the State Duma this month. The bill “On Digital Financial Assets” is going to legalize blockchain technologies, mining operations and initial coin offerings. The other draft is supposed to amend Russia’s Civil Code in order to regulate the use of “digital money” and protect the investors. The bills should be adopted in June or July.

Earlier in March, a working group proposed tax exemptions on profits from crypto-related transactions after a meeting at the Ministry of Economic Development in Moscow. It gathered representatives of several government institutions and the private sector. Gazprombank also took part in the consultations.

Do you expect more Russian banks to enter the crypto sector after its legalization? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Do you agree with us that Bitcoin is the best invention since sliced bread? Thought so. That’s why we are building this online universe revolving around anything and everything Bitcoin. We have a store. And a forum. And a casino, a pool and real-time price statistics.

The post Gazprombank to Try Crypto Deals in Switzerland appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2pTJPr1

via IFTTT

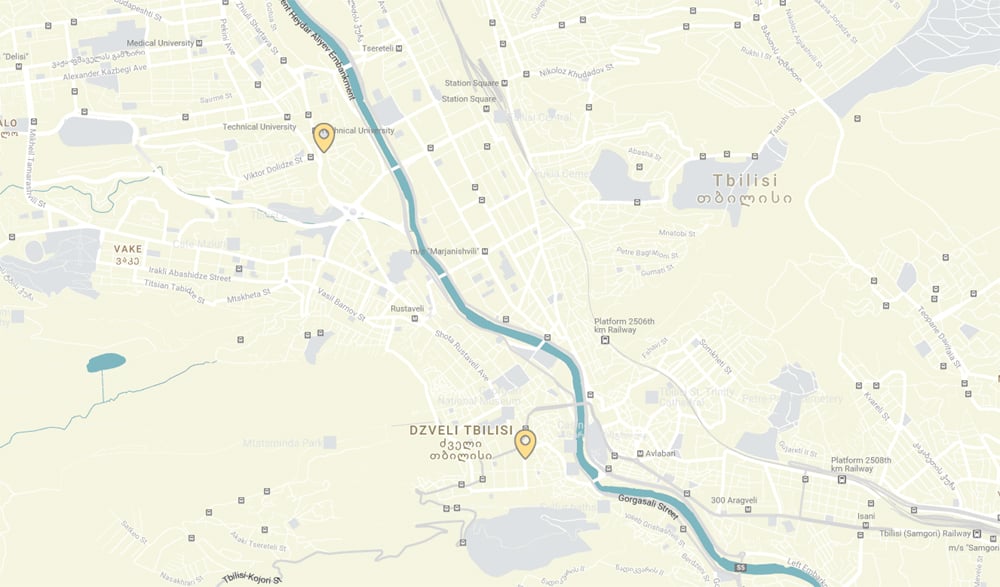

Bitcoin ATM Installed in Georgia Amid Growing Interest in Crypto

A new automated teller machine now offers Georgians a fast and easy way to buy and sell bitcoin and litecoin. Support for bitcoin cash has been promised, and other cryptos will also be added in the future. The ATM has been set up at a burger restaurant in the heart of the Georgian capital Tbilisi.

Also read: Crypto Business Is Now Legal in Belarus

Bitcoins and Burgers

Cryptocurrencies in Georgia have been gaining popularity in recent years. The country has become a regional leader in the adoption of bitcoin and blockchain technologies. A new cryptocurrency terminal has been set up in Tbilisi offering the opportunity to exchange bitcoins and litecoins with the Georgian lari. The company behind the initiative promises to provide support for bitcoin cash and plans to introduce other cryptos, like ethereum.

The new BATM has been installed at the New York Burger restaurant between Tkvarcheli Street and Merab Kostava Street in the Georgian capital, not far from the 26 May Square. It is operated by a local firm called TPS. The company provides exchange services through cash terminals and an online trading platform.

The new BATM has been installed at the New York Burger restaurant between Tkvarcheli Street and Merab Kostava Street in the Georgian capital, not far from the 26 May Square. It is operated by a local firm called TPS. The company provides exchange services through cash terminals and an online trading platform.

According to Coinatmradar, another crypto ATM, which also supports bitcoin and litecoin transactions, can be found on 12 Shalva Dadiani Street in Tbilisi. Both teller machines are manufactured by the Prague-based company General Bytes.

More and more people in the Caucasus believe cryptocurrencies are the future of money. According to Giorgi Cheishvili, programmer at TPS, the popularity of digital coins is growing every day, and the Georgian market reflects the global trends.

“Many people want to exchange their cryptos and a growing number of Georgians are interested in buying cryptocurrency,” he told the local news outlet Marketer. In his opinion, Georgia is a leading country when it comes to opportunities to obtain bitcoin and the like.

“Many are interested in crypto innovation and business,” noted Anthony Sollimon, manager of the New York Burger restaurant. “We want to create a convenient environment where they will be able to make the necessary transactions,” he added.

A Regional Crypto Leader

Georgia is considered a pioneer in crypto legalization among countries in the South Caucasus. In the last several years, it has implemented blockchain technologies, both in the private and the public sector. Since 2016, the country’s land register has been maintained on a blockchain. Georgia is also home to one of the first bitcoin mining farms in the region.

Georgia is considered a pioneer in crypto legalization among countries in the South Caucasus. In the last several years, it has implemented blockchain technologies, both in the private and the public sector. Since 2016, the country’s land register has been maintained on a blockchain. Georgia is also home to one of the first bitcoin mining farms in the region.

Special courses are currently offered in Tbilisi for those who want to expand their knowledge of cryptocurrencies. Members of the Georgian crypto community have invited experts from EU countries to take part in the educational program.

Georgia’s neighbor Armenia has been trying to catch up in recent months. A bill to regulate cryptocurrency mining was introduced in Yerevan in February, as reported by news.Bitcoin.com. The proposed legislation offers crypto miners tax exemptions and other incentives. Operators of mining facilities will not be required to apply for any permissions or licenses. According to local experts, the draft law will effectively legalize cryptocurrency transactions.

Do you think the availability of bitcoin ATMs helps the adoption of cryptocurrencies? Share your thoughts in the comments section below.

Images courtesy of Shutterstock, Coinatmradar, Google Maps.

Bitcoin News is growing fast. To reach our global audience, send us a news tip or submit a press release. Let’s work together to help inform the citizens of Earth (and beyond) about this new, important and amazing information network that is Bitcoin.

The post Bitcoin ATM Installed in Georgia Amid Growing Interest in Crypto appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2pRgbUe

via IFTTT

Featured Post

BITCOIN (BTC) blockch✂️ain FORKS

🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧 Bitcoin Cash: Forked at Block 478558, 1 August 2017, For each 1 BTC you get 1 BCH Bytether: Cross for...