from #Bitcoinmovement https://ift.tt/2Tcmunj

via IFTTT

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/2UIJRVE

via IFTTT

from #Bitcoinmovement - The hub of Bitcoin and Crypto media https://ift.tt/3w4ISfx

via IFTTT

There are so many benefits to using a cryptocurrency, that it would seem foolish to neglect such an invention. For example, it allows you to send money anywhere in the world in an instant, with basically no fees involved. Everyone can be included in the financial system, it will change the way we interact with money, it can prevent fraud, and much more.

A Summary of Arkham Intelligence’s Takedown of ICP

On-Chain Analysis

Implications

Off-Chain Analysis

Seed Supporter’s Struggles

Implications

Please utilize this sticky thread for all general Bitcoin discussions! If you see posts on the front page or /r/Bitcoin/new which are better suited for this daily discussion thread, please help out by directing the OP to this thread instead. Thank you!

If you don't get an answer to your question, you can try phrasing it differently or commenting again tomorrow.

Join us in the r/Bitcoin Chatroom!

Please check the previous discussion thread for unanswered questions.

Coinbase, the largest exchange in terms of crypto reserves held, has announced the introduction of a savings program tied to usd coin. The company’s high yield USDC savings program allows customers to gain 4% APY interest on stablecoin accounts.

The cryptocurrency exchange Coinbase announced pre-enrollment for its usd coin (USDC) savings program that allows clients to earn a 4% APY interest rate on USDC held on the platform.

Coinbase joins firms like Blockfi and Crypto.com that already offer interest on USDC stablecoin holdings. Still, Coinbase highlights in its announcement on Tuesday, that 4% APY on USDC is “more than 8x the national average of high-yield savings accounts.”

“Everyone wants to get the best interest rate available for the assets they hold,” Coinbase explained in a statement. “But interest rates have decreased steadily over the past few decades, making it difficult to earn meaningful passive income on your assets,” the company said. Coinbase added:

The national average for a traditional savings account hovers around 0.07%, with high-yield savings accounts still falling well short of even 1%.

Coinbase’s entry into the stablecoin savings products also follows Circle’s USDC business product, which was launched in November 2020. At the time, Circle revealed the launch of high-yield USDC business accounts with APY up to 10.75%. Additionally, Circle just announced five days ago, it would be launching a new API so companies can connect to high-yield decentralized finance (defi) platforms.

Coinbase and Circle are the founding members of the Centre consortium and with a number of other consortium members, Centre is the issuer and custodian of the usd coin (USDC) project.

In order to get more information on Coinbase’s USDC pre-enrollment, U.S. customers can sign up at the web portal coinbase.com/lend. After an individual gains approval, they will “automatically start to earn 4% APY on the USDC” they hold in their Coinbase account. The company does detail that “APY may change at any time before you start lending.”

What do you think about Coinbase offering 4% APY on USDC holdings? Let us know what you think about this subject in the comments section below.

PRESS RELEASE. One of the leading blockchain-based NFT & Metaverse platforms, Dvision Network, has revealed that its long-awaited “Open Beta Test” (OBT) is going live on June 30th 2021. According to Dvision Network, the Open Beta Test launch will be divided into several phases, with the following stages to be announced after the successful completion of the 1st phase. The countdown has already started on their official website: https://dvision.network/.

Open Beta Test to incorporate new NFT features

The Open Beta Test is the test phase that will precede the launch of Dvision World, an ultimate metaverse that will be a major platform of the Dvision Network’s Ecosystem. Dvision Network has integrated new features into the OBT, including My Space, Character Customization, and a community Leaderboard system.

During the OBT, users will be able to fully customize their characters with options like selecting preferred nicknames and desired costumes for their characters, and will further be able to utilize their avatars to enjoy the virtual reality experience within the Dvision World. The avatars are able to implement several cool functions, such as animation, teleportation and socialization, which should boost their performance and enhance the time-spending inside of the metaverse.

The My Space feature provides a tailored virtual space where users can obtain their personal piece of a virtual estate within the Dvision World. Users can also purchase different items to build their virtual space according to their needs and preference.

Dvision World is expected to provide an innovative metaverse experience that will transform the NFT sector. Users will be able to engage in different economic activities by utilizing NFT standards to protect their digital assets like Avatars, Virtual Spaces, and Items within the Dvision Network’s robust NFT Market.

Fast-growing Ecosystem

Although Dvision Network’s OBT is only paving its way towards future development, it is regarded as one of the fastest-growing blockchain-based metaverses in the sector, which has achieved a range of milestones in recent months. As a matter of fact, Dvision Network is currently ranked fifth in the Metaverse Sector right behind Axie Infinity, Sandbox, and Decentraland according to CoinMarketCap. Dvision Network is also regarded to be one of the largest BSC and NFT projects in the space with its current market capitalization, which constitutes around 60 million USD with its floating supply of 21%, whereas FDMC is valued around 260 million USD.

It should also be noted, that Dvision Network team is continuously making significant developments in the marketing and business aspects, holding different cross-promotion activities and campaigns focused on expanding its community. Dvision recently conducted a huge airdrop with leading cryptocurrency price aggregator CoinMarketCap where 150,000 DVI tokens ($65,000) were distributed among 2,000 lucky winners, and before that they did the similar in collaboration with DappRadar. Currently, the Dvision community comprises over 200,000 members across all social media channels.

Previously, Dvision Network has revealed, that they have built the bridge to Binance Smart Chain in collaboration with Curvegrid, and since then, they have continued to make noticeable waves in the Binance Smart Chain (BSC) ecosystem, with their participation in the MVB program, followed by their recent AMA on the BSC official channel. Dvision’s upcoming NFT Market is expected to significantly boost their performance level on the Binance Smart Chain, which shall further elevate their position in their ecosystem.

Dvision has also embarked on high-profile partnerships with other blockchain protocols to improve its infrastructure. The NFT metaverse revealed a strategic collaboration with BSC turnkey solution platform Ankr in June. In the nutshell, Dvision Network is utilizing Ankr distributed nodes to power its cross-chain bridge and NFT Marketplace.

Dvision Network native token DVI has also continued to show a decent performance, with its recent rebound of 65% after it took a dive followed by a market downturn led by BTC fall. DVI recently got listed on Indodax and Bittrex, opening up the access to token to more users globally. Indodax is the largest regulated exchange in Indonesia with more than 4 million users, while Bittrex is considered to be one of the reputable and largest platforms in Europe.

About Dvision Network

Dvision Network provides web-based real-time streaming 3D VR metaverse service so that users can easily experience metaverse content such as fairs and games. On the Division platform, anyone can easily create NFT items without any development-related expertise. Division’s NFT trading system enables monetization by directly connecting creators and consumers without intermediaries. This serves to connect the virtual world to reality.

All these products are powered by the Dvision Network utility token DVI, listed on several exchanges, including Uniswap, Bithumb, Coinone, Bittrex, Indodax, and Hoo.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

A Summary of Arkham Intelligence’s Takedown of ICP

On-Chain Analysis

Implications

Off-Chain Analysis

Seed Supporter’s Struggles

Implications

A Summary of Arkham Intelligence’s Takedown of ICP

On-Chain Analysis

Implications

Off-Chain Analysis

Seed Supporter’s Struggles

Implications

Please utilize this sticky thread for all general Bitcoin discussions! If you see posts on the front page or /r/Bitcoin/new which are better suited for this daily discussion thread, please help out by directing the OP to this thread instead. Thank you!

If you don't get an answer to your question, you can try phrasing it differently or commenting again tomorrow.

Join us in the r/Bitcoin Chatroom!

Please check the previous discussion thread for unanswered questions.

Please utilize this sticky thread for all general Bitcoin discussions! If you see posts on the front page or /r/Bitcoin/new which are better suited for this daily discussion thread, please help out by directing the OP to this thread instead. Thank you!

If you don't get an answer to your question, you can try phrasing it differently or commenting again tomorrow.

Join us in the r/Bitcoin Chatroom!

Please check the previous discussion thread for unanswered questions.

PRESS RELEASE. June 2021, leading Crypto service comparison site – Cryptowisser, attempts to dissipate the cloud of confusion surrounding tax regulations on crypto currencies around the world. As the tax season comes to a close and a record amount of crypto traders are holding, how do you legally save your crypto?

It is no surprise that as the recent surges and as alt coins continue flooding the market, more and more people are seeing it as a potential way of making money. And the once fabled mysterious currency, is well, becoming more regulated. Like anything else, regulatory boards are catching on and impicating tax laws.

As the Cryptowisser tax essentials report states, the majority of crypto tax either comes from Income Tax or Capital Gains tax.

Tax free crypto conditions still exist –

The report clarifies Geo advantageous spots for crypto traders- Malaysia for example, does not tax crypto trading unless it is a registered business. Other crypto transactions such as donations and “gift sums” are tax free depending on the amount and location.

The report also clarifies that the simplest way to avoid crypto tax is to keep transactions Fiat free. For the most part actually buying crypto has no tax, you can buy as much as you want, only to pay the fees on whatever crypto exchange you decide to use. Wallet to wallet crypto transfers also avoid tax.

Capital Gains Tax on Crypto –

Any investment gain made from crypto currency will be looked at the same as any other investment- and tax will be paid unless in a capital gain tax free country such as New Zealand, Sri Lanka, Singapore etc. In most countries however, that is not that case. Cryptowisser reported on the countries with the highest crypto capital gains tax here. The report also explains taxed crypto transactions such as selling crypto holdings, exchanges and online shopping.

Crypto Income Tax

With the increase of remote based companies, with employees often in other countries, crypto has become a popular payment option. However, any earnings you do make from your employment, crypto or not, has to be declared and paid. Even if you are making gains with mining crypto, tax will be paid.

Concluding Remarks

The future of crypto tax is bittersweet, the more accepted and adopted it is, the more regulation there will inevitably be. Countries with more favourable crypto conditions will attract investors and likely stabilize crypto currency as legal tender leading to a more crypto positive future.

Cryptowisser is a cryptocurrency services comparison site with the world’s largest, most frequently updated and most trusted lists of cryptocurrency exchanges, wallets, debit cards and merchants. With more than 1,000 reviews of the various exchanges, debit cards, wallets and merchants, they help you make all of your purchasing decisions and service choices in the crypto world.

For more information please contact press@cryptowisser.com

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Remember when the bull was strong and unstoppable, most people around me wanted to buy BTC. Most of them said and hoped that if BTC was still 30K I would have bought a shit ton of it.

Those mates of mine now still do not buy and are hoping for it to dip to 10k or less. I told them that it is very unlikely. Not impossible but very unlikely. They still held strong and didn't want to buy till it dips more and I believe they won't if it does.

There is a saying and it goes something like this:

"If you cannot love (buy) me (crypto) on a discount, they don't deserve me when I bull"

Please utilize this sticky thread for all general Bitcoin discussions! If you see posts on the front page or /r/Bitcoin/new which are better suited for this daily discussion thread, please help out by directing the OP to this thread instead. Thank you!

If you don't get an answer to your question, you can try phrasing it differently or commenting again tomorrow.

Join us in the r/Bitcoin Chatroom!

Please check the previous discussion thread for unanswered questions.

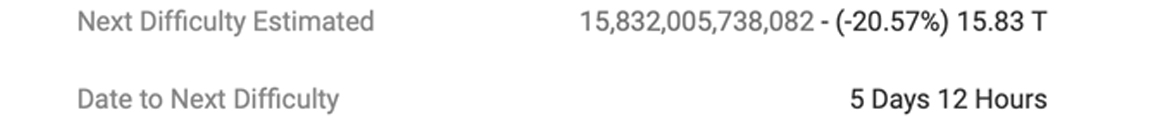

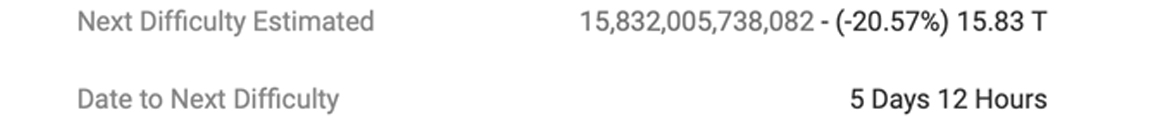

On Saturday, Bitcoin’s SHA256 hashrate managed to climb back above the 100 exahash per second region after it slid to a low of 91 EH/s three days ago. Meanwhile, in five days the network’s mining difficulty change is approaching and it could see the difficulty drop over 20%.

What do you think about the hashrate climbing back after the crackdowns in China? Let us know what you think about this subject in the comments section below.

It becomes a self fulfilling prophecy. The more people on here saying I’ll buy when it hits $15k, $20k, $25k, etc. are shooting themselves in the foot. We want people to buy. We want new people interested in BTC and crypto and if they all believe this is going to dip, they won’t enter the market and…. The correction/dip will continue. We need buying pressure, not selling. Wouldn’t you rather have everyone going in now, in the low-to-mid $30,000s and just keep buying as it continues to stay sideways or go up? When we start hitting all-time highs, are you really going to care that you bought at $25k vs $30k?

$65k to $30k is the dip. Start buying and stop talking about the hypothetical lower price you’re going to buy at. Some broken record advice… DCA. Invest 1/52nd of what you want to invest in total every week. And if that dip comes that you’ve been waiting for… stop the DCA strategy and and back up the truck to buy as much as you want.

steps off soapbox

Remember when the bull was strong and unstoppable, most people around me wanted to buy BTC. Most of them said and hoped that if BTC was still 30K I would have bought a shit ton of it.

Those mates of mine now still do not buy and are hoping for it to dip to 10k or less. I told them that it is very unlikely. Not impossible but very unlikely. They still held strong and didn't want to buy till it dips more and I believe they won't if it does.

There is a saying and it goes something like this:

"If you cannot love (buy) me (crypto) on a discount, they don't deserve me when I bull"

Please utilize this sticky thread for all general Bitcoin discussions! If you see posts on the front page or /r/Bitcoin/new which are better suited for this daily discussion thread, please help out by directing the OP to this thread instead. Thank you!

If you don't get an answer to your question, you can try phrasing it differently or commenting again tomorrow.

Join us in the r/Bitcoin Chatroom!

Please check the previous discussion thread for unanswered questions.

On Saturday, Bitcoin’s SHA256 hashrate managed to climb back above the 100 exahash per second region after it slid to a low of 91 EH/s three days ago. Meanwhile, in five days the network’s mining difficulty change is approaching and it could see the difficulty drop over 20%.

What do you think about the hashrate climbing back after the crackdowns in China? Let us know what you think about this subject in the comments section below.

It becomes a self fulfilling prophecy. The more people on here saying I’ll buy when it hits $15k, $20k, $25k, etc. are shooting themselves in the foot. We want people to buy. We want new people interested in BTC and crypto and if they all believe this is going to dip, they won’t enter the market and…. The correction/dip will continue. We need buying pressure, not selling. Wouldn’t you rather have everyone going in now, in the low-to-mid $30,000s and just keep buying as it continues to stay sideways or go up? When we start hitting all-time highs, are you really going to care that you bought at $25k vs $30k?

$65k to $30k is the dip. Start buying and stop talking about the hypothetical lower price you’re going to buy at. Some broken record advice… DCA. Invest 1/52nd of what you want to invest in total every week. And if that dip comes that you’ve been waiting for… stop the DCA strategy and and back up the truck to buy as much as you want.

steps off soapbox

https://www.binance.com/en/support/announcement/ba03469c86f34546bd25faf414730733#

Fellow Binancians,

As part of our continuing compliance efforts, Binance has updated its Terms of Use to provide that Ontario (Canada) has become a restricted jurisdiction, effective 2021-06-26 at 3:59:59 AM (UTC). Regrettably, Binance can no longer continue to service Ontario-based users. Ontario-based users are advised to take immediate measures to close out all active positions by December 31, 2021.

We apologize for any inconvenience caused.

Thanks for your support!

Fuck this clown province

Please utilize this sticky thread for all general Bitcoin discussions! If you see posts on the front page or /r/Bitcoin/new which are better suited for this daily discussion thread, please help out by directing the OP to this thread instead. Thank you!

If you don't get an answer to your question, you can try phrasing it differently or commenting again tomorrow.

Join us in the r/Bitcoin Chatroom!

Please check the previous discussion thread for unanswered questions.

🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧🛑🚧 Bitcoin Cash: Forked at Block 478558, 1 August 2017, For each 1 BTC you get 1 BCH Bytether: Cross for...